Although the pandemic feels like it happened long ago, many sectors of the economy are still struggling to recover from its lasting effects, and the office real estate sector is certainly one of them. The pandemic caused significant disruptions, and the sector continues to face challenges as companies, employees, and investors adapt to new workplace realities. The shift to remote work and changing workforce preferences triggered a downturn that saw vacancy rates soar and demand plummet, as many companies began rethinking their long-term office space needs. While the sector is still struggling with ongoing challenges, there is hope on the horizon as demand begins to increase and net absorption turns positive in several large urban centers.

Let’s take a closer look at the timeline of the office sector’s journey through the pandemic and beyond.

The Pandemic’s Immediate Impact on Office Real Estate and the Struggle for Recovery

When the pandemic hit, businesses had to shift to remote work quickly. Offices emptied as lockdowns and health concerns forced millions of people to work from home. This shift dramatically reduced demand for office space, particularly in large urban centers such as New York, San Francisco, and Los Angeles. For instance, in New York City, net absorption fell to an all-time low of -31.1 million square feet in early 2021—reflecting a record-high surplus of vacated rather than occupied office spaces. Respectively, net absorption fell to -10.1 million square feet in San Francisco.

As the markets reopened post-pandemic, many sectors began to recover; yet the office real estate sector faced several challenges, and experienced even higher vacancy rates. This shift to remote and hybrid work became permanent for many companies, allowing employees to split their time between the office and remote locations. This new normal significantly reduced the need for large office spaces, as fewer employees were in the office. As a result, businesses started looking for smaller and more flexible office arrangements, further weakening demand for traditional long-term leases. By the end of the third quarter of 2024, the vacancy rate had reached a record high of 13.8%.

Positive Signs: Net Absorption Turning Positive in Many Major Urban Centers

After several quarters of negative absorption—where more office space was vacated than leased—some markets are beginning to see net absorption turning positive. This is a hopeful sign that demand could slowly recover in certain areas.

While many companies embraced remote work, some have gradually shifted back to in-person work. Amazon has ordered all staff to be back in the office five days a week (at the start of 2025), ending its hybrid work model. Other companies like JPMorgan Chase and Disney have also moved toward in-person work. These trends suggest that many large corporations are prioritizing in-office work as they move into the new year. As a result, this return has increased demand for office space in several areas.

In the meantime, the job market remains robust, with industries like tech, life sciences, health care, and professional services experiencing consistent expansion. As companies hire more employees and grow, they also need more office space to accommodate their new staff. Thus, with growth usually comes the need for more office space—particularly since most of these expanding industries rely on in-person collaboration.

Strong Rebound in the Past Year, Turning Net Absorption Positive

More than half of the metro areas have higher net absorption now compared to a year ago. However, nearly 40% of them are still below the pre-pandemic level.

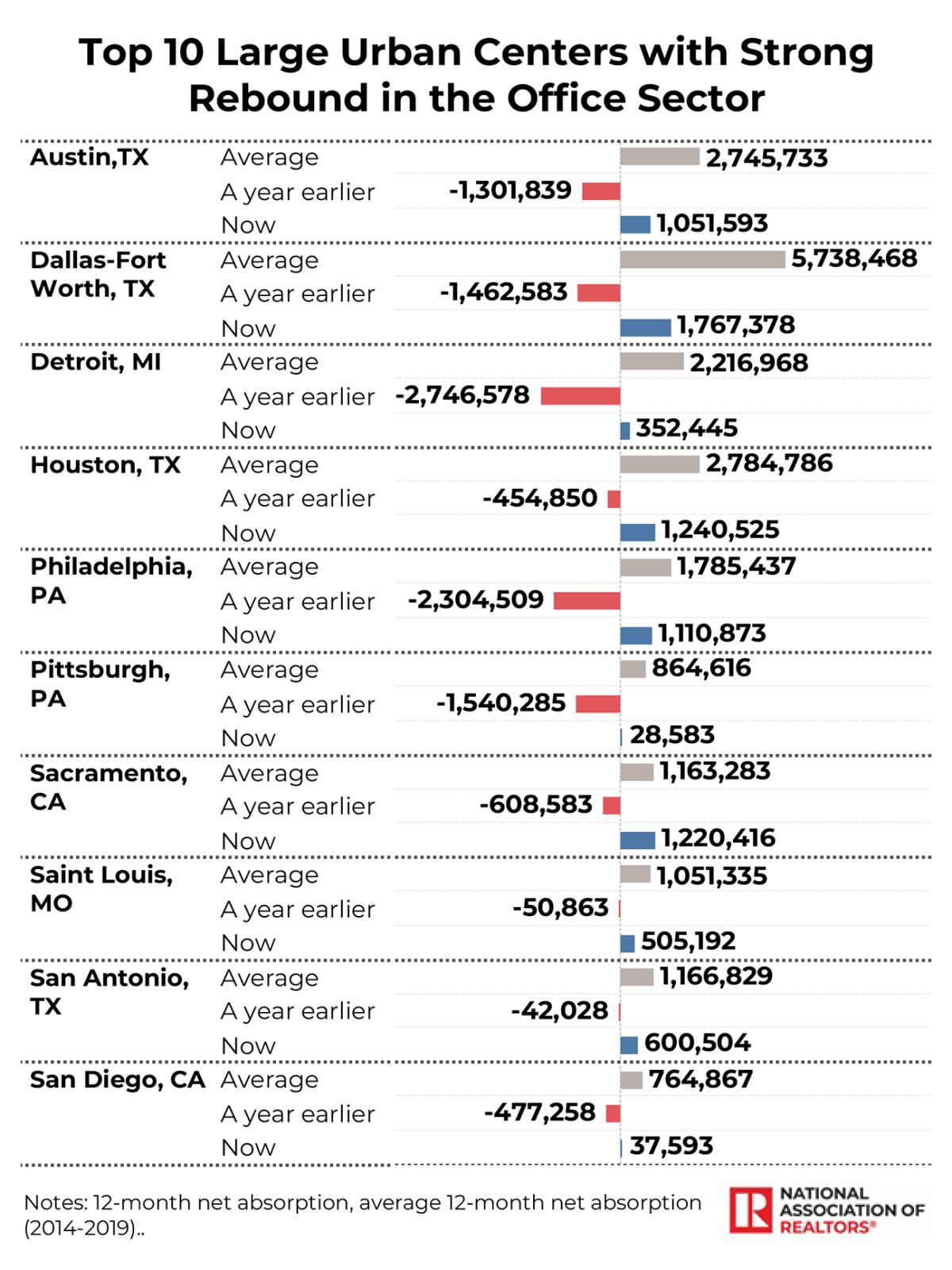

Large urban areas: Philadelphia, Dallas, Austin, Sacramento, and Houston

Net absorption has turned positive in these major urban centers, with more than 1 million square feet of office space leased than vacated. While net absorption was negative last year, it has since turned positive, indicating that leased office space now exceeds vacated space. For instance, Philadelphia has seen a remarkable shift. Net office absorption was -2.3 million square feet, but it has now improved to +1.1 million square feet. Thus, over the past year, Philadelphia has converted more than 3.4 million square feet of office space into leased space.

Texas’s “Triangle” (Austin, Dallas, and Houston) net absorption has increased significantly due to continued business relocations, expansions, and strong job creation. However, net absorption in these urban centers remains below pre-pandemic levels.

Sacramento stands out as the only one of these top five large urban centers to surpass its pre-pandemic net absorption levels. Its pre-pandemic absorption was 1.16 million square feet, and it has now exceeded 1.24 million square feet, marking a notable recovery.

Mid-sized Urban Areas: Columbia, Indianapolis, Columbus, Provo, and Cincinnati

These mid-sized urban centers have also experienced a strong rebound in the office space sector. In Columbia, SC, more than 1 million square feet are leased rather than vacated. However, net office absorption was -255K square feet a year ago. Many companies are opting to expand or relocate to mid-sized urban areas, attracted by lower costs of living and doing business compared to larger metropolitan areas. These centers offer a more affordable alternative for companies looking to cut costs while maintaining access to talent and infrastructure. In the meantime, many mid-sized cities have experienced population growth as people relocate from larger cities to more affordable areas. In addition, mid-sized areas—such as Columbus, OH, and Indianapolis, IN—are hubs of industries such as health care and manufacturing. Growth in these sectors is driving job creation, which is also reflected in stronger demand for office space as companies expand to meet their labor and operational needs.

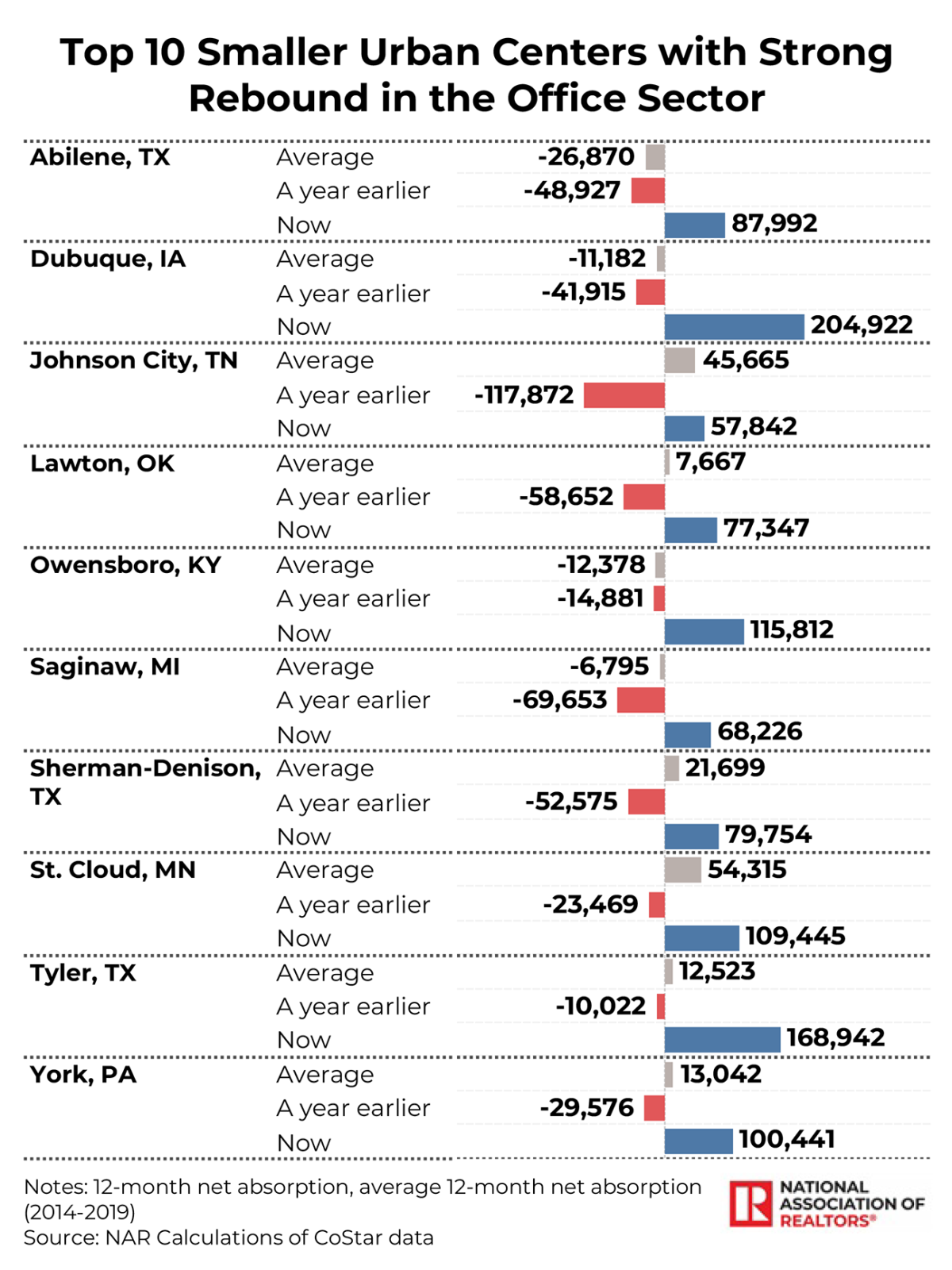

Small Urban Areas: Dubuque, Tyler, Johnson City, Abilene, and Lawton

Demand has increased in several smaller urban centers, with office net absorption often surpassing pre-pandemic levels. For instance, in Tyler, TX, 12-month office net absorption was about 168.9K square feet as of the end of Q3 2024, compared to -10.0K square feet a year ago and 12.5K square feet as the average level.

While each market has unique factors driving demand, most of these smaller urban areas are experiencing faster population growth and job creation in key industries (such as health care and military services) than before the pandemic. Although not close to larger urban centers, they offer affordability and job opportunities. Tyler has seen strong job growth, particularly in health care and education, which seems to have contributed to the increase in office space demand. There are about 9% more jobs in this area than before the pandemic. Additionally, household growth in Dubuque, Abilene, and Lawton is faster than at the national than pre-pandemic levels.

Strong demand, surpassing pre-pandemic levels: Sacramento, Columbia, Odgen, New Haven, and Roanoke

In 26% of metro areas, office space is currently performing better than pre-pandemic. Sacramento, Columbia, SC, Ogden, New Haven, and Roanoke are leading this group. For instance, Sacramento’s net absorption reached 1.22 million square feet as of Q3 2024, surpassing the 1.16 million average from 2014-2019. Respectively, in Roanoke, VA, the current net office absorption is about 4 times what it was in the five-year pre-pandemic period (2014-2019).

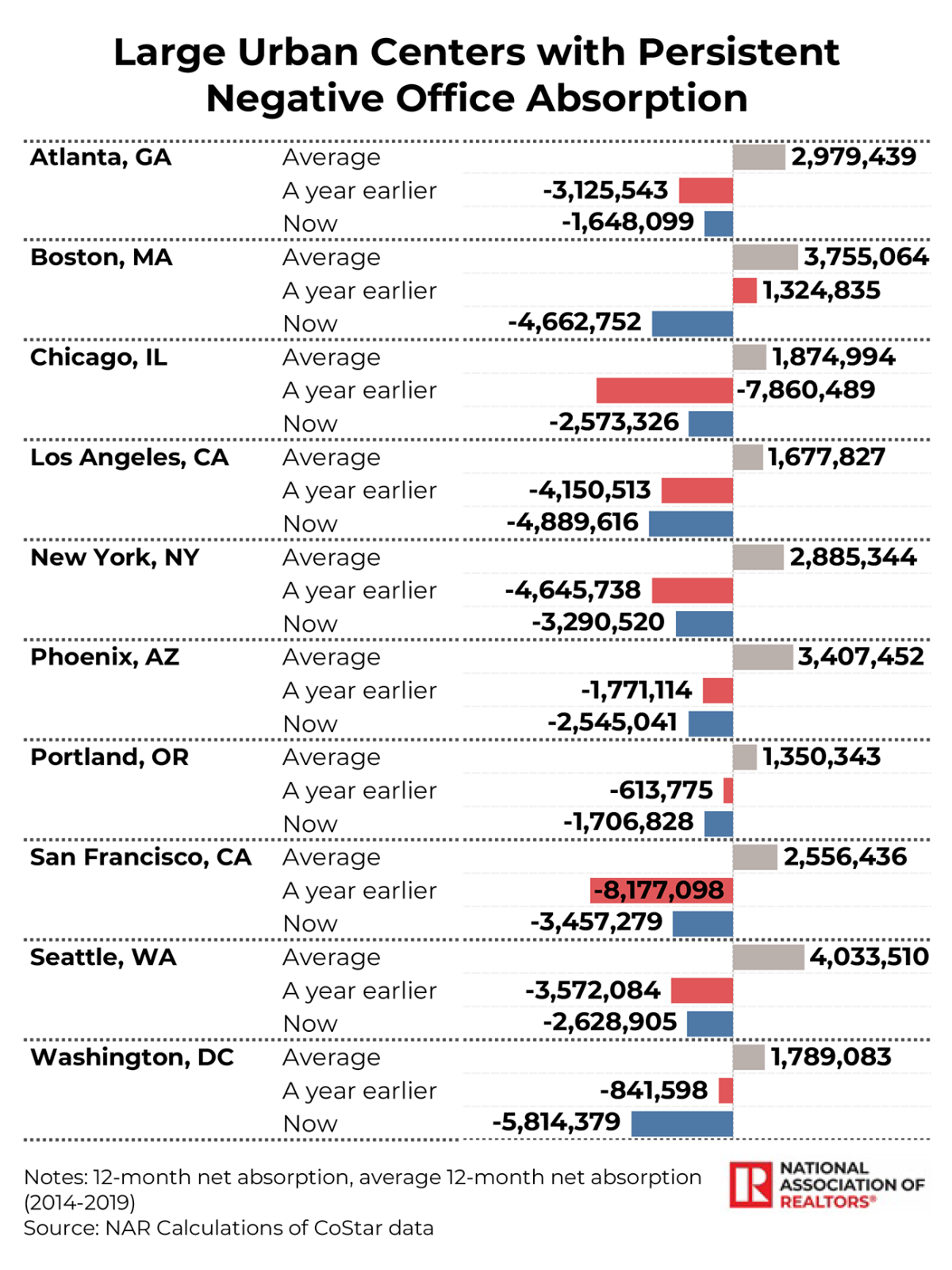

Large urban centers with persistent negative office absorption: Washington, DC, Los Angeles, Boston, San Francisco, and New York

Despite some improvement, several major urban centers that experienced the steepest declines during the pandemic continue to struggle with high levels of vacant office space. Net office absorption remains negative in Washington, D.C. (-5.8 million sq. ft.), Los Angeles (-4.9 million sq. ft.), Boston (-4.7 million sq. ft.), San Francisco (-3.5 million sq. ft.), and New York (-3.3 million sq. ft.). While the office sector has improved in most of these markets compared to a year ago, these gains have not been enough to bring net absorption into positive territory. However, net office absorption has weakened further in Boston and Los Angeles compared to last year. Many of these high-cost areas are losing professionals and companies due to the high cost. For example, Los Angeles experienced the most net migration losses from job switchers in Q3 2023 compared to any other metro area.

While the office real estate sector continues to struggle from the long-lasting effects of the pandemic, there are signs of recovery in certain areas. As businesses adjust to new workplace realities, the office sector will likely continue to evolve, with some areas experiencing a faster rebound than others. Although the office space sector still has a long way to go for a full recovery, positive net absorption in key markets indicates that the worst may be over.

Visit NAR's Commercial Real Estate Metro Market Reports to see more statistics.