The multifamily market was the most attractively bought property asset in past years. In 2019, multifamily deals totaled $186.9 billion, nearly a third of the $585.7 billion in commercial property transactions.1 What is the financing outlook for the multifamily market at this time and in the long-run? A comparison of the share of private financing today compared to the share prior to the Great Recession and the CARES Act assistance to unemployed workers and multifamily loan borrowers suggest that the effect on credit financing for multifamily acquisitions is positioned to be less severe than during the Great Recession. The demand for multifamily properties is fundamentally strong with low rental vacancy rates in many metropolitan areas, which is a positive factor for multifamily investors.

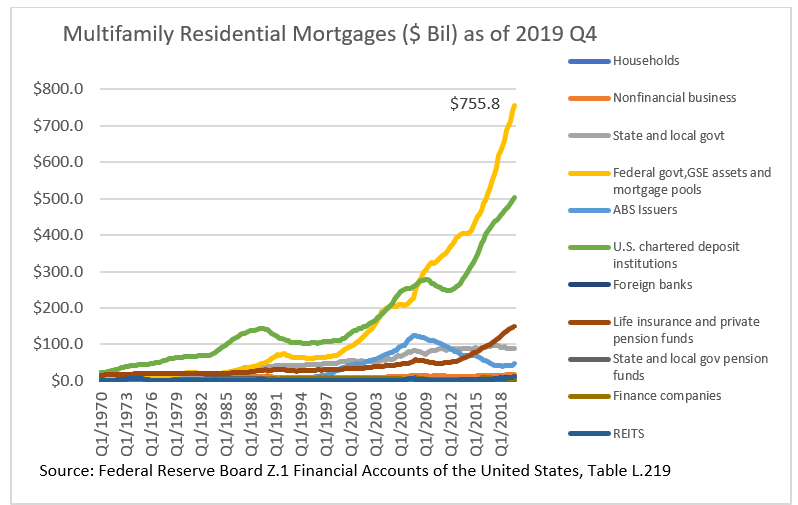

Federally-backed loans account for a larger share today at 43%

Private sector lending now accounts for a smaller share of the market than it did pre-Great Recession. In 2006, federal mortgages2, GSE mortgages, and GSE-backed mortgages accounted for only 30% of total multi-family mortgages totaling $1.593 trillion. As of 2019 Q4, the share of federally-backed loans has increased to 47% of multifamily mortgages (federal, $11.6 billion; GSE mortgages, $364 billion; GSE-backed mortgage pools, $380.2 billion).

Private asset-backed securities (ABS) issuers have not come back strongly since 2007 when private ABS issuers mortgages totaled $123.9 billion, or 15% of multifamily mortgages. As of 2019 Q4, ABS issued mortgages was only at $47.6 billion or 3% of outstanding multifamily mortgages. Meanwhile, lending by depository institutions have doubled since 2012, from $251 billion to $502.9 billion. However, relative to the total mortgages of $1.59 trillion, their share has declined somewhat from 36% in 2006 to 32% in 2019 Q4. How they will continue to provide credit to multifamily mortgage will therefore be important to the financing of multifamily mortgages. Multifamily lending by life insurance companies have also increased. In level terms, their lending has roughly tripled from nearly $48 billion in 2006 to nearly $150 billion in 2019, accounting for a higher share of multifamily mortgages, from 7% in 2006 to 9.4% in 2019 Q1. However, life insurance companies will see an increasing payout for deaths from COVID-19 so they back away from multifamily investments if they perceive cash flows (rents) to be risky at a time of rising unemployment, especially among retail trade and leisure workers who are the most impacted by social distancing measures.

The question is whether GSEs will step in if private funding starts to dry up. Currently, FHFA has set a multifamily loan purchase cap of $100 billion each for the GSEs for the five-quarter period Q4 2019 – Q4 2020, with at least 37.5% of the Enterprises’ multifamily business be mission-driven, affordable housing. This is lower than the total lending of $140 billion in 2018.3 However, FHFA’s policy as stated in its FAQ is for the GSEs multifamily business to play a countercyclical role in the multifamily market.4

More financial assistance to unemployed workers and to incentives to keep workers

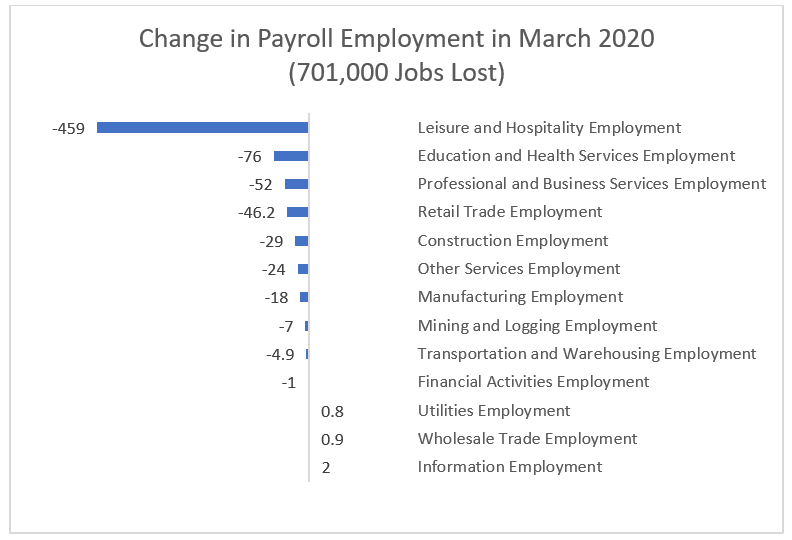

The social distancing measures put in place to contain the spread of coronavirus have largely affected workers in the retail trade and leisure sectors. Of the 701,000 jobs lost in March 2020 (relative to February 2020), 72% were in leisure and hospitality (-459,000) and in retail trade (-46,200).

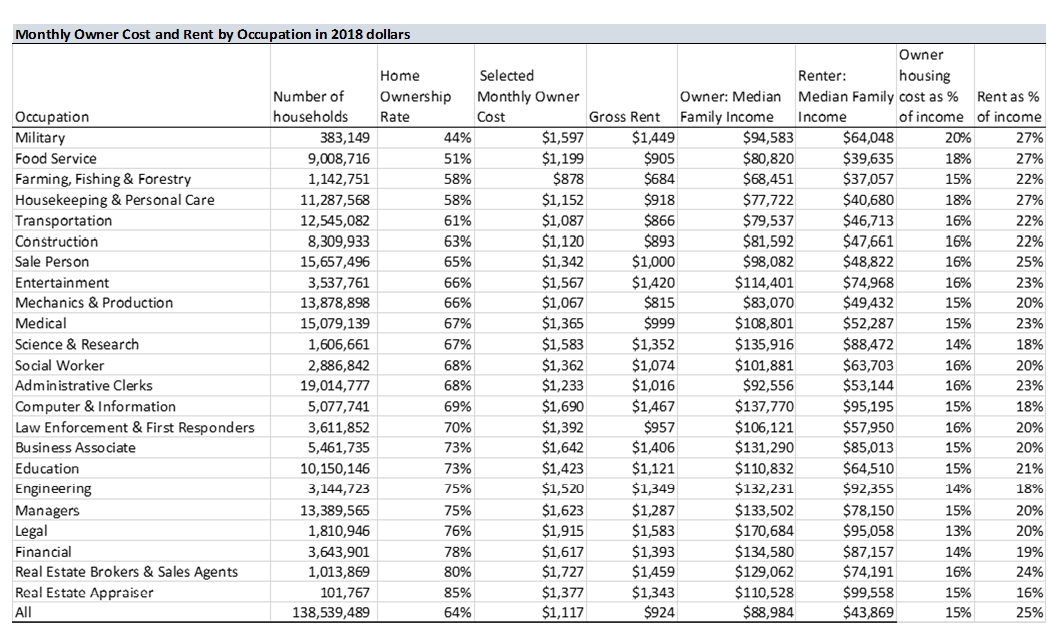

The concentration of job loss in these sectors has an impact on the multifamily market because food service workers, housekeeping and personal care workers are more likely to be renters compared to other occupational groups. Only 51% of food service workers are homeowners and only 58% of housekeeping and personal care workers are homeowners, well below the national rate of 64% (author’s tabulation of 2018 American Community Survey PUMS data)5. The average gross rent for these workers is about $900.

One program that will help unemployed workers to keep paying rent is the Pandemic Unemployment Assistance (PUA)1 program. This program provides $600 weekly on top of the unemployment insurance benefits under the federal-state program for a maximum of 39 weeks during the period January 27, 2020 through December 31, 2020.6 The PUA also expands coverage to self-employed workers and workers, freelancers, and independent contractors, workers seeking part-time work, and workers who wouldn’t be covered under the regular state program.

I compared the average weekly wage in February 2020 to the average weekly state unemployment insurance benefit from the current federal-state program and the additional $600 (UI + $600) from the Pandemic Unemployment Assistance (PUA) program under the $2.2 trillion CARES Act. In 34 states, the insurance benefit + $600 makes up and even exceeds the average weekly wage. However, in the District of Columbia and in 16 states, the UI + $600 will not fully replace the lost wages on average. The 16 states include states such as California (-$186), Alaska (-$134), Arizona (-$98), Maryland (-$88), New York (-$85), Connecticut (-$78), Virginia (-$72), Washington ($-65), Louisiana ($-54), and Florida ($-27).

In the states where the expected UI payment + $600 won’t fully restore lost wages, workers will struggle to meet their rent payments and may not be able to fully make the rent payment. However, the CARES Act provides up to 90 days’ forbearance for borrowers with a federally backed, multifamily mortgage loan who experience a financial hardship and during this time, they may not evict or charge late fees to tenants for the duration of the forbearance period. However, as noted above, federal and GSE loans account for 47% of multifamily mortgages. However, the FDIC, the Board of Governors of the Federal Reserve System (FRB), the Office of the Comptroller of the Currency, the National Credit Union Administration, the state banking regulators, and the Consumer Financial Protection Bureau have encouraged financial institutions to work with borrowers affected by COVID-197.

Demand for multi-family properties is fundamentally strong

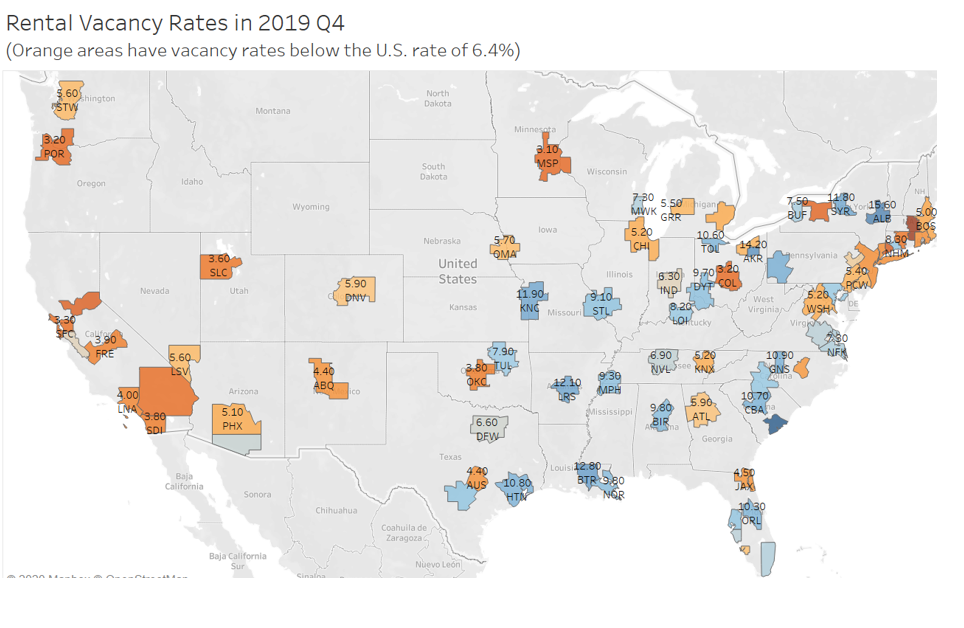

The demand for multifamily properties is fundamentally strong, which supports a positive outlook for investors looking to finance multifamily properties. Nationally, the U.S. rental vacancy rate is a low 6.4% as of 2019 Q4. Rental vacancy rates are even lower in California metropolitan areas (less than 4%) Portland Oregon (3.2%), Phoenix (5%), Salt Lake City (4%), Austin (4%), Jacksonville (4%), New York (4%), and Oklahoma (4%).

1 Source: Real Capital Analytics. RCA tracks only properties or portfolios of at least $2.5 million.

2 Federal mortgages include mortgages owned by Ginnie Mae, the Federal Home Loan Banks, and other federal instrumentalities. https://www.fhfa.gov/Media/PublicAffairs/PublicAffairsDocuments/newmultifamilycaps-9132019.pdf

3 Counting the “green” loans that are now part of 2019-2020 cap.

4 FHFA Fact Sheet. New Multifamily caps for Fannie Mae and Freddie Mac, https://www.fhfa.gov/Media/PublicAffairs/PublicAffairsDocuments/newmultifamilycaps-9132019.pdf

5 Thanks to Hua Zhong, Senior Data Scientist, for creating the data cube that was used to tabulate the data.

6 The Pandemic Unemployment Assistance (PUA) program runs from Jan. 27, 2020 through Dec. 31, 2020 and provides unemployment insurance benefit for a maximum of 39 weeks during the period January 27, 2020 through December 31, 2020.

7 https://www.fdic.gov/news/news/financial/2020/fil20022.pdf