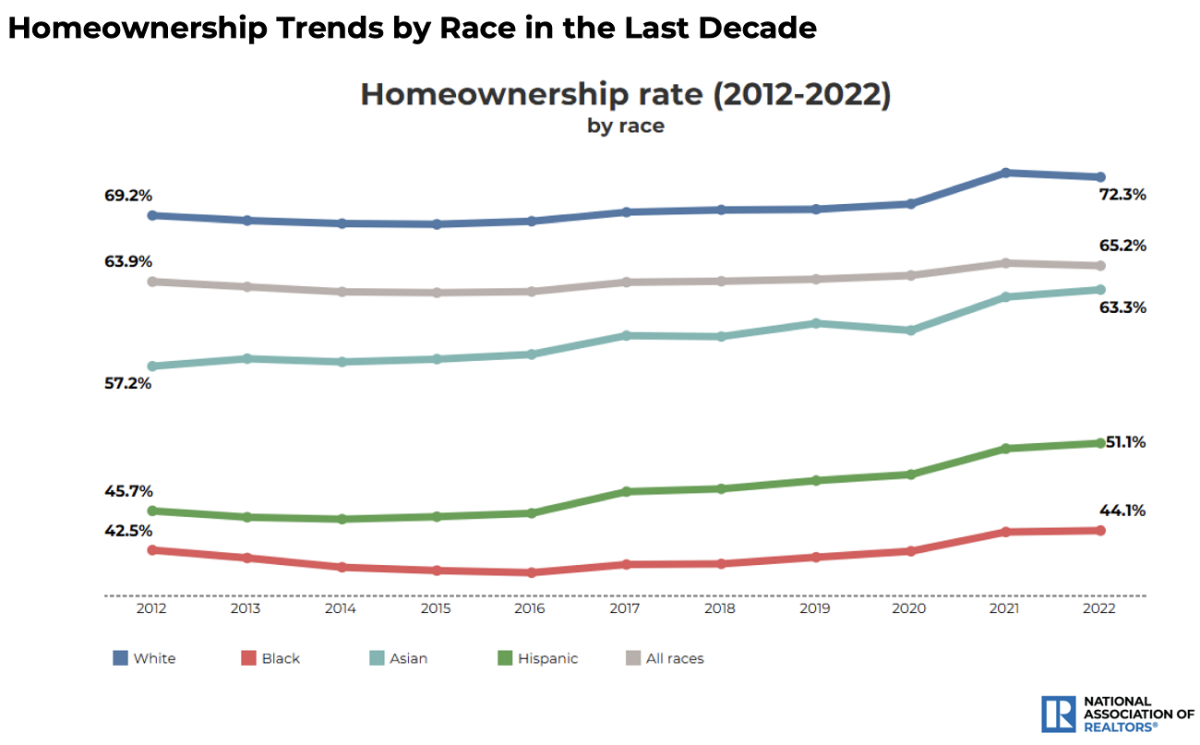

Homeownership among Asians and Hispanics in the U.S. has hit an all-time high, reaching 63.3% and 51.1%, respectively, according to the National Association of REALTORS®’ 2024 Snapshot of Race and Home Buying in America. The report, which reflects 2022 data, the most recent available, shows an uptick in homeownership rates across minority groups. The overall U.S. homeownership rate in 2022 was 65.2%.

“Minority homeownership gained ground,” says NAR Deputy Chief Economist Jessica Lautz. But “while the gains should be celebrated, the pathway into homeownership remains arduous for minority buyers.”

Housing affordability, access to credit, rising student loan debt and additional obstacles continue to challenge ethnic and minority home buyers in a disproportionate way, the report cautions. Still, Hispanic and Asian Americans were able to gain notable ground, posting the largest homeownership rate gains over the last decade. Hispanic Americans posted a 5.4 percentage point increase compared to 2012, adding about 3.2 million homeowners over the last decade. Asian Americans posted a 6.1 percentage point increase compared to 2012, translating to nearly 1.5 million more homeowners.

Progress and Challenges

Overall, there were 10.5 million new homeowners in the U.S. between 2012 and 2022, with the homeownership rate in America rising from 63.9 % to 65.2% in that time, according to NAR data. But not all races have fared well.

The Black homeownership rate, at 44.1%, continues to lag behind other groups, NAR’s report notes. Affordability challenges persist, and disparities may be pressing on racial and ethnic groups particularly hard. For example, in Colorado, 41% of Black homeowners spend more than 30% of their income on housing compared to 24% of White homeowners. The report also notes that in places like Hawaii and Iowa, the gap in the share of cost-burdened White and Black homeowners is greater than 30 percentage points.

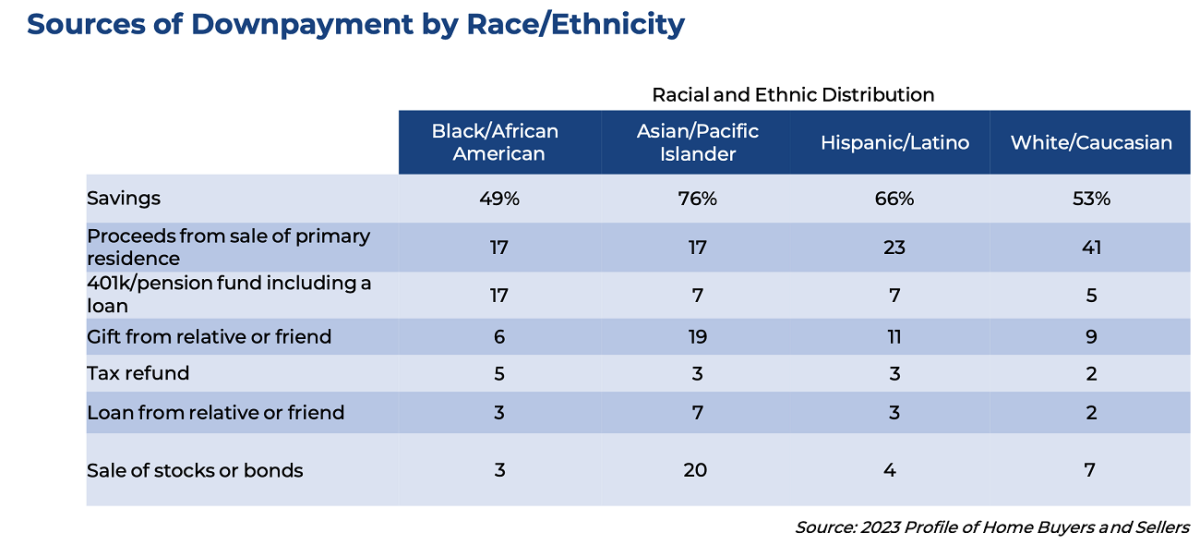

“The impacts of housing affordability and limited inventory are more extreme for minority buyers because more than half are first-time buyers who must rely on down payment sources beyond gained housing equity,” says Lautz. Further, as rents increase nationwide, fewer renter households will have the ability to save for a down payment on a home.“Even among successful home buyers, minorities have a higher amount of student debt—the biggest expense that holds back saving, along with rent.”

NAR’s report shows that Black home buyers report the highest share of student loan debt, at 41%, with a record median amount of $46,000. Twenty-nine percent of Hispanic home buyers report having student loan debt, with a median amount of $33,300.

Pooling Resources

To get into homeownership, home buyers across races may find a teamwork approach beneficial. Twenty-four percent of Black home buyers, 23% of Asians and 22% of Hispanics purchased a multigenerational home in 2022—compared to only 12% of Whites, the report notes. The most common reasons for purchasing a multigenerational home are taking care of or spending more time with aging parents or relatives, cost savings and wanting a larger home that multiple incomes can afford together, according to the report.

“The family continues to play a large role in helping buyers in entering the market,” the NAR report notes. Many Asian and Hispanic buyers also relied on a gift or financial help from a relative or friend for their down payment, at 26% and 14%, respectively, the report notes.