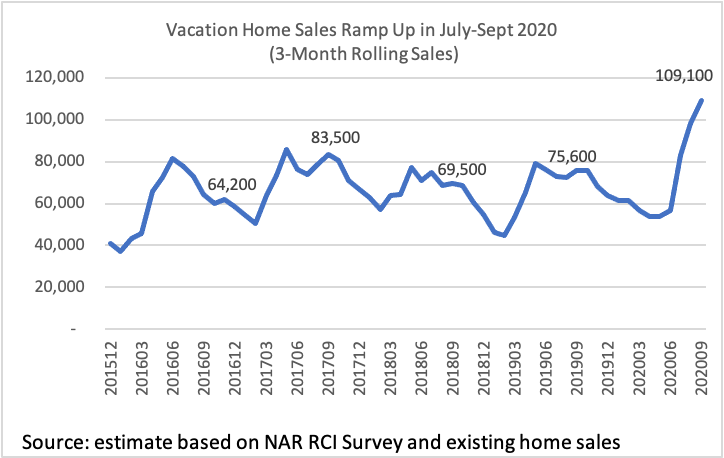

Vacation home sales are outperforming total existing-home sales. Sales of homes intended for vacation use rose to 109,100 in the past three months of July-September, a 44% gain from the level of 75,600 sales during the same period last year, according to NAR estimates based on information gathered from the monthly REATORS® Confidence Index Survey1 and NAR’s existing-home sales estimates. In comparison, total existing-home sales during July-September rose 13% year-over-year (1.72 million in July-Sept 2020 vs. 1.52 million in July-Sept 2019).

The pandemic and low mortgage rates have increased the desirability and affordability of owning a vacation home. Buyers may be desiring a vacation home as a weekend getaway as urban-based leisure activities are still constrained by social distancing. The ability to work from home also means buyers who can work from home can spend more time at and enjoy their vacation home. Historically low mortgage rates have also made a home purchase more affordable, while rising prices in past years have yielded larger home equity gains that can be tapped (through say a home equity loan) to use for a down payment.

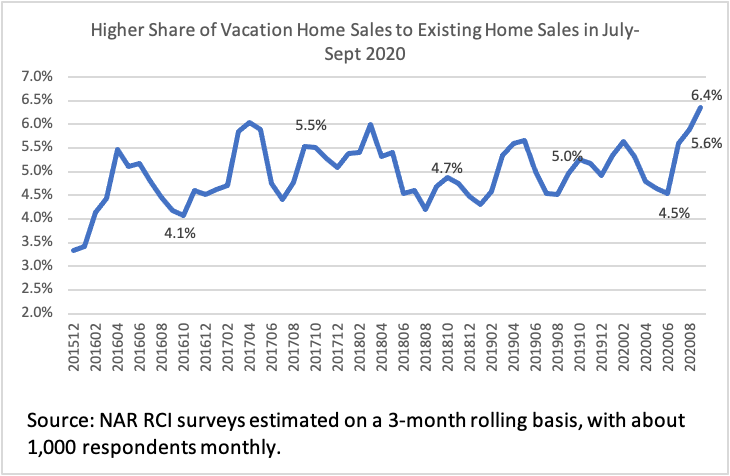

In terms of market share, vacation homes accounted for 6.4% of total existing-home sales during July-September, up from the 5% share during the same period in 2020 and the historical share since October 2015 when NAR started collecting this information. During June-August, the sales share had also ticked up to 5.6%.

Among the 200 counties which NAR identified as vacation home counties, 81% had year-over-year sales gains. These include vacation home counties that have vacation spots such as, Itasca, Minnesota (Itasca State Park); Northumberland, Virginia (Northern Neck Peninsula of Chesapeake Bay); Summit, Colorado (Breckenridge, Keystone, Frisco resorts); Coconino, Arizona (Grand Canyon); Windham, Vermont (Stratton Mountain Resort); Barnstable, Massachusetts (Cape Cod); Warren, New York (Adirondack Mountains); Sussex, Delaware (Rehoboth Beach); Cape May, New Jersey (Cape May); Brunswick, North Carolina (Brunswick Islands); Horry, South Carolina (Myrtle Beach); and Lee, Florida (Manatee Park), to name a few.

NAR has identified a county as a vacation home county if at least 20% of the housing stock is for seasonal use. Based on this definition, 10% of 3,142 counties in the United States are vacation home counties. Most are found in the coastal areas and the Great Lakes.

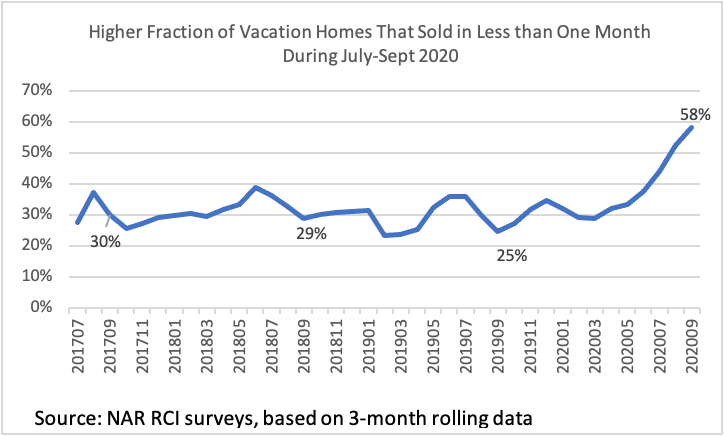

Vacation Homes Sold Faster

Not only did more second homes get sold, they sold faster compared to historical norms. Of second homes where the sale closed during July-September 2020, 58% of those homes sold within one month, a higher fraction compared to 25% one year ago and the average of about 30%. Nationally, 71% of existing homes that closed in September were on the market for less than one month.

Fewer foreign buyers due to travel ban

With the coronavirus travel bans still in place from foreign nationals from China, Iran, the European Schengen area, the United Kingdom, Republic of Ireland, and Brazil, the share of foreign buyers purchasing second has declined from an average of about 3% to 0.9% as of the 3-month period of July-Sept 2020. According to NAR’s International Transactions in U.S. Residential Real Estate, China is the U.S. top foreign buyer of U.S. residential real estate, accounting for 12%; European buyers make up 13%; and Brazil, 3%.

Characteristics of Vacation Home Buyers

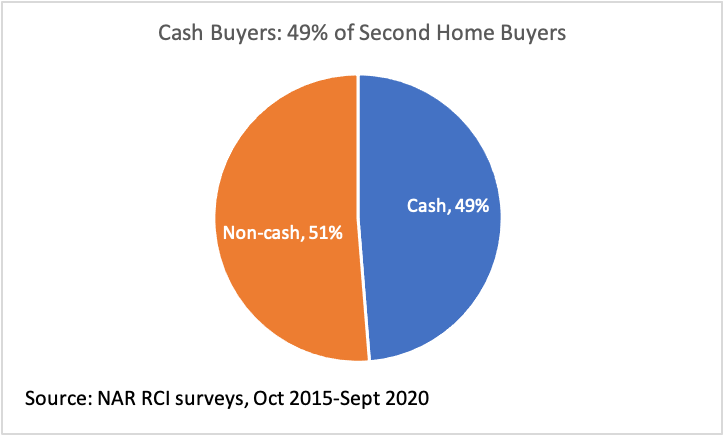

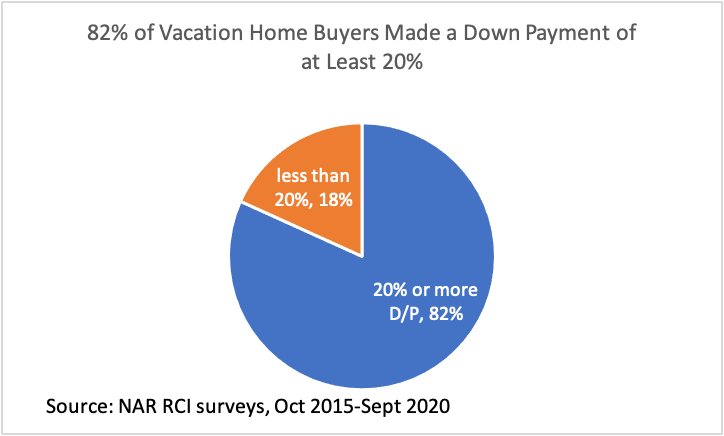

Information collected from the monthly REALTORS® Confidence Index surveys since October 2015 through September 2020 reveals the following characteristics of second-home buyers. Second-home buyers are nearly all repeat buyers and have the financial wherewithal to make an all-cash payment and put down at least 20% down payment.

- 96% of vacation home buyers were repeat buyers, and the remaining were 4% are first-time buyers;

- 49% of vacation home buyers paid all cash;

- 82% of vacation home buyers made a down payment of at least 20%

- 3% of vacation home buyers were international buyers (non-US citizens)

- 61% of vacation home buyers purchased detached single-family homes

- 89% of vacation home buyers purchased in a resort area (39%), small town or rural area (30%), and suburban (20%)

1 There were 3,507 respondents who reported that buyers who closed a sale during July to September intended to use the property as a vacation home. The survey asked, “What was the intended use of this buyer?” and the answer choices were: 1) primary residence, 2) vacation home for family or friends; 3) investment rental; 4) don’t know. The share of vacation home sales is calculated as number of vacation home to total responses measured on a 3-month rolling basis. The 3-month rolling share is then multiplied to the 3-month total of the monthly non-seasonally adjusted total existing-home sales.