Of late there have been questions around two statistics surrounding women purchasing homes: why women are more likely to buy homes, and how their financials compare to single men buying homes. The answers are worth looking into.

Women have been second only to married couples in the home buying market since NAR started data collection on the topic in 1981. What is striking about this statistic was that it wasn’t until 1974 that women were legally protected to obtain a mortgage without a co-signer. Prior to the passage of the Fair Housing Act’s prohibitions against “sex” discrimination in housing-related transactions, and the protections of the Equal Credit Opportunity Act, it was commonplace for a widow to need a male relative as a co-signer. Women had no legal recourse under federal law for this or any other kind of lending discrimination.

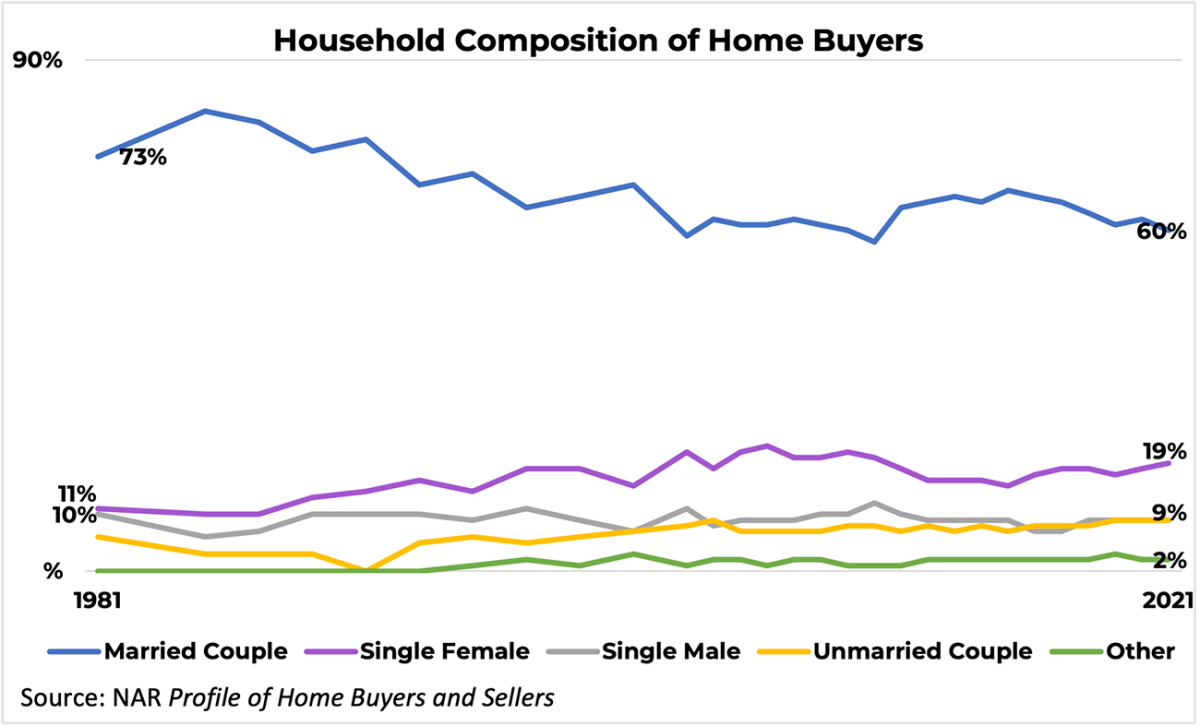

In 1981, 73% of home buyers were married couples, 11% were single women and 10% were single men. Today those shares stand at 60% married couples, 19% single women, and 9% single men. The highest share of single women buyers was in 2006 when the share stood at 22%. After 2006, the share of single women buyers dropped incrementally to a recent low in 15% in 2015. Since 2015, the share of single women has risen to a recent high of 19%. In 2010, the share of single men rose to a high of 12% but has stayed in recent years between 7% to 9% of buyers.

In recent years, an easy explanation for the rise in single women buyers was the drop in the share of Americans who are married. Using Census data, in 1990, 59% of the American public was married, and today just 52% of the U.S. is married. Comparing the two charts of recent home buyers compared to the overall population, the trend mirrors one another:

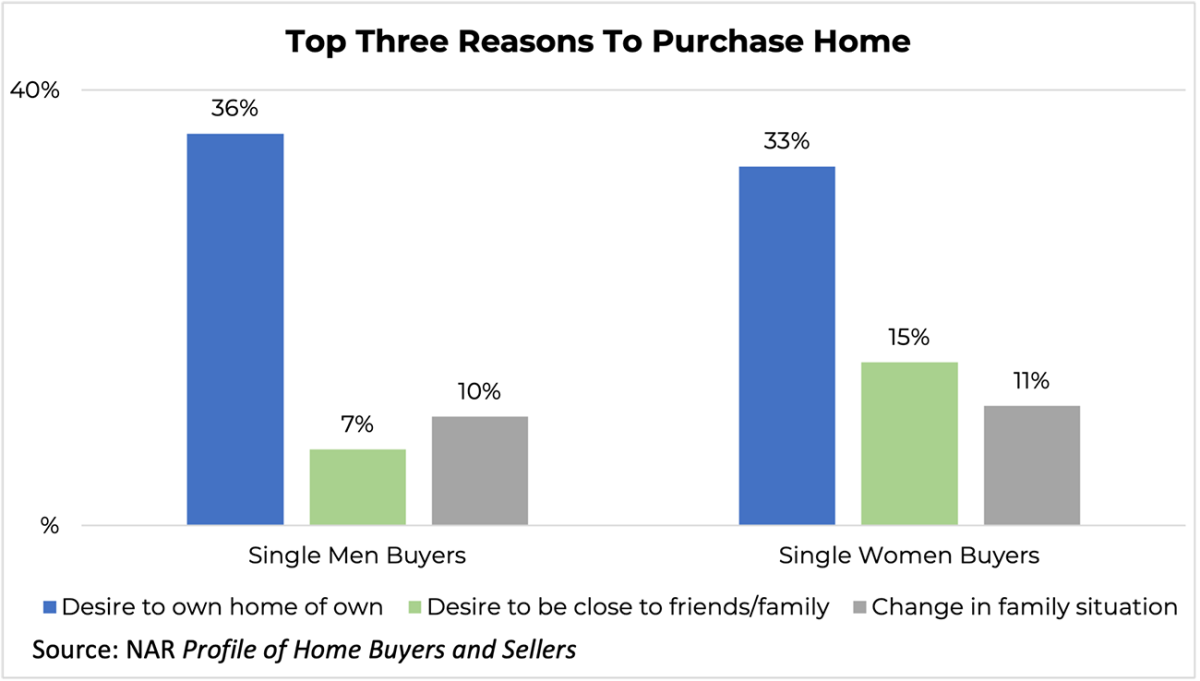

But then why are women buying homes and men are not? For that answer, it is best to turn to who is buying and the composition of their household. Both men and women are most likely to say they are purchasing for the desire to own a home of their own, but then double the share of women purchase to be close to friends and family. When collecting data on whether or not a buyer is single now, a data point not collected is if the buyer was once married and is now widowed or divorced, but in both scenarios the proximity to friends and family may be important to women.

Looking at the composition of the household also helps to tell the story. Single women buyers are more likely to purchase a home with a child under the age of 18 and are more likely to purchase a multi-generational home (housing adult siblings, adult children, and/or grandparents). These family obligations may make purchasing a home more attractive to a single woman buyer as she has the need for stable housing on a continual basis.

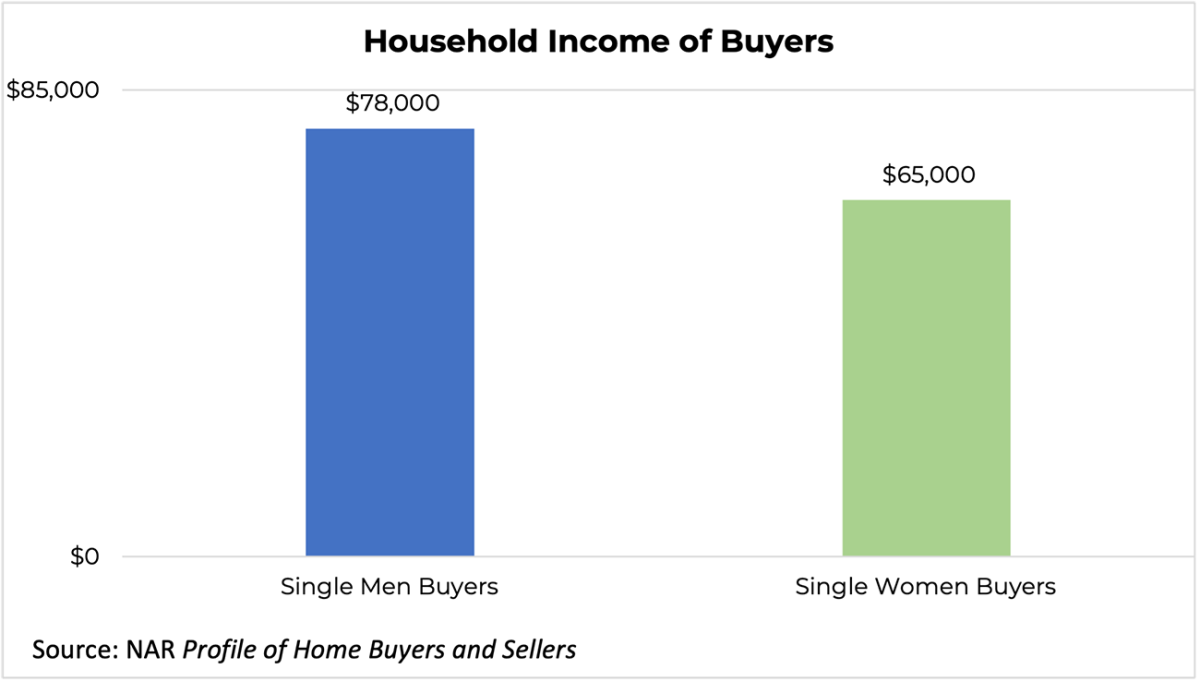

The second major question posed is finances. Women home buyers typically purchase a home at a household income of $65,000 compared to single men at $78,000. While male incomes do not match that of married couples or unmarried couples, their higher incomes do allow them more buying power than single women buyers.

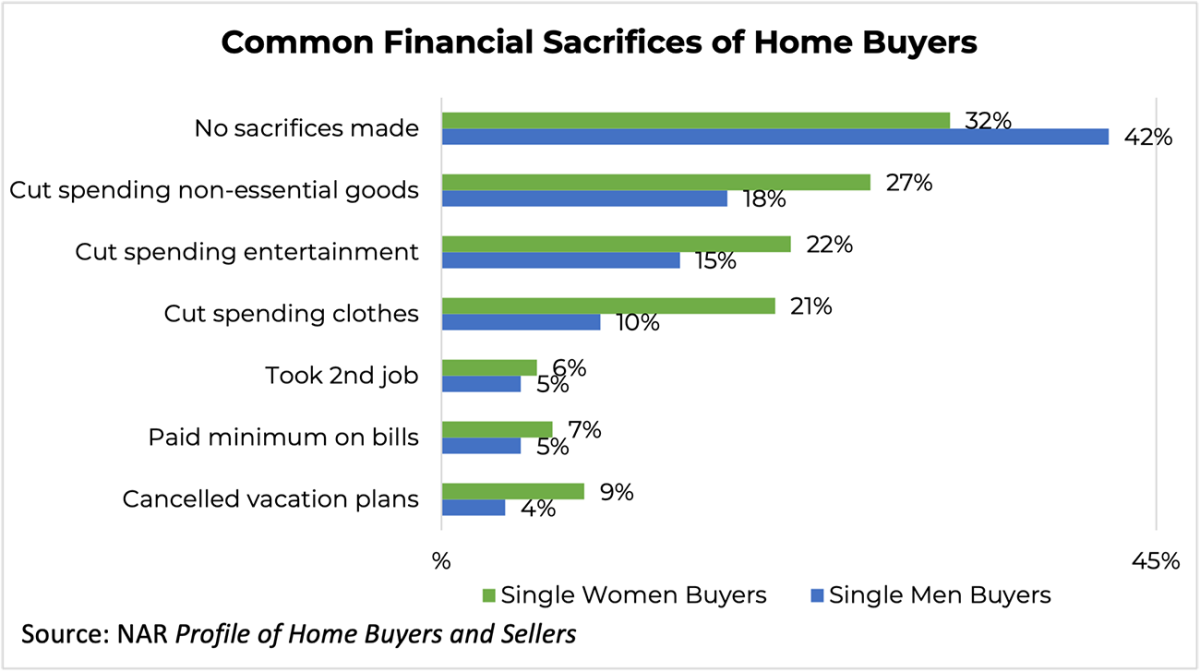

Given the financial pressures of children within the home and their lower household income, women do make more financial sacrifices when purchasing. Forty-two percent of women make financial sacrifices compared to 32% of men who purchase homes. Common financial sacrifices include cutting spending on non-essential goods, entertainment, clothes, and cancelling vacation plans. These sacrifices only underscore how important homeownership is to women as these sacrifices at all outpace those of male buyers. These sacrifices may add up and happen over a number of years. Among all buyers, single women are 51 compared to single men at 45. First-time women buyers are 34 compared to men at 31.

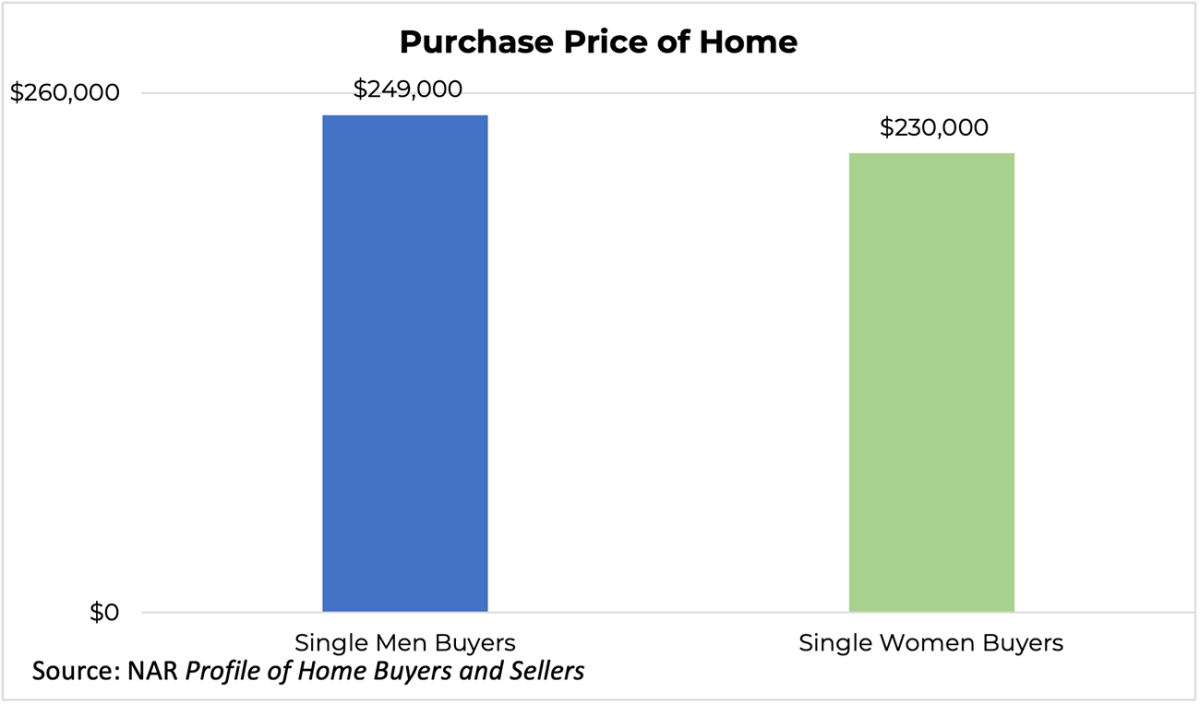

When women do purchase homes, they are likely to purchase homes that are at a lower price point than single men buyers. Men typically purchased homes that were $249,000 last year, compared to women who purchased homes that were $230,000. While the price difference may not be a gamechanger for some, for many in an environment where home prices are experiencing double digit year-over-year home price gains, while also experiencing historically low housing inventory, finding an affordable property for oneself and possible dependents could be arduous. But women are out there, and are successfully making home purchases.

For more on these trends and others, check out the full Profile of Home Buyers and Sellers report.