The housing sector not only provides shelter—a basic human need—but also plays an integral role in both global and local economic growth. Beyond its primary function, the housing sector initiates a series of activities that propel economic growth.

Specifically, the housing sector is a significant contributor to gross domestic product (GDP) through construction, home sales, and renovations. While these activities require labor and materials, they also stimulate production and job creation across multiple industries, including construction, manufacturing, and retail. Furthermore, home purchases, particularly older ones, typically trigger additional consumer expenditures. These new homeowners often invest in home improvement projects, furniture, appliances, and services to personalize and update their living spaces. However, the economic impact of the housing sector extends even further. The construction of new homes and the renovation of existing ones require labor, creating a wide range of jobs, from architects and builders to interior designers. Moreover, the real estate sector—encompassing agents, brokers, and mortgage lenders—also employs a significant number of professionals. The ripple effects of a booming housing market, therefore, can be substantial in reducing unemployment and boosting people’s income.

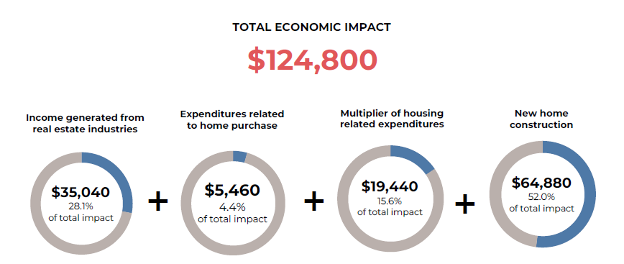

To better understand the housing market's importance to the local economy, the National Association of REALTORS® computes the income generated from each home sale, considering the activities mentioned above, for each state. Nationwide, NAR estimates that the real estate market contributed 18%—equivalent to $4.9 trillion—to the GDP in 2023. Specifically, each home sale at the median generated about $125,000 in 2023.

Below is the detailed breakdown of contributions from each activity resulting from the purchase of a median-price existing home.

State-by-State Analysis

Among the top states for the economic contribution of real estate were Florida (24.1%), Nevada (23.2%), Delaware (23.1%), and Arizona (23.1%), where the sector accounted for more than 23% of the state's GDP. This significant figure indicates a thriving market fueled by a booming population and an influx of technology and manufacturing firms in these areas. For example, Arizona's real estate market benefits from its relatively affordable living costs and investment in infrastructure, making it a powerhouse of economic activity and growth.

Although California accounted for a smaller share of the real estate market relative to its vast overall economy, at 17.6%, the value of real estate contributions to its GDP was the highest among all states, amounting to approximately $680 million. The high value of real estate in California reflects its status as an attractive place to live, work, and invest, driving substantial economic activity.

After analyzing the total income generated from home sales, California, Hawaii, and the District of Columbia emerge as the three standout states, influenced significantly by the high property values in these areas. California leads the nation with an economic impact of $233,500 per home sale in 2023. Hawaii and the District of Columbia follow, with impacts of $214,700 and $200,400, respectively, highlighting the influence of high property values and dense, affluent populations in these states.

Jobs Impact of an Existing-Home Sale

Focusing on the real estate market's role in job creation, the National Association of REALTORS® estimates that each home sale generates two jobs. This calculation is based on the broader economic impact of existing-home sales and the average earnings in the U.S. Specifically, while each home sale contributes approximately $124,800 to the economy, the average U.S. worker earns $61,700. Therefore, using this ratio, 1,000 home sales would result in the creation of 2,000 jobs.

However, the impact of a home sale can be even more significant in certain areas. California, Hawaii, Maine, Montana, and Idaho are the states with the largest impact on job creation from home sales. For instance, more than three jobs are generated in California and Hawaii from every home sale.

Looking Ahead

Based on the analysis, the housing market is not just a sector of the economy but a significant force driving economic activity. In states like Florida, Nevada, and Arizona, real estate’s contribution to the local economy is even more pronounced, with contributions to GDP exceeding 23%. Moving forward, using the impact of the real estate market will be important for improving the economic growth and resilience of both the country and local markets.