While job relocation may not be the most common reason for moving—trailing behind housing and family reasons—the influx of workers into new areas significantly impacts local economies and real estate markets. These new residents bring more than just moving trucks; they bring economic potential, drive up demand for housing, and can even spark shifts in regional development. The current analysis delves into the job-to-job flows across states to identify the areas that are most popular among job switchers.

Where Are Workers Moving?

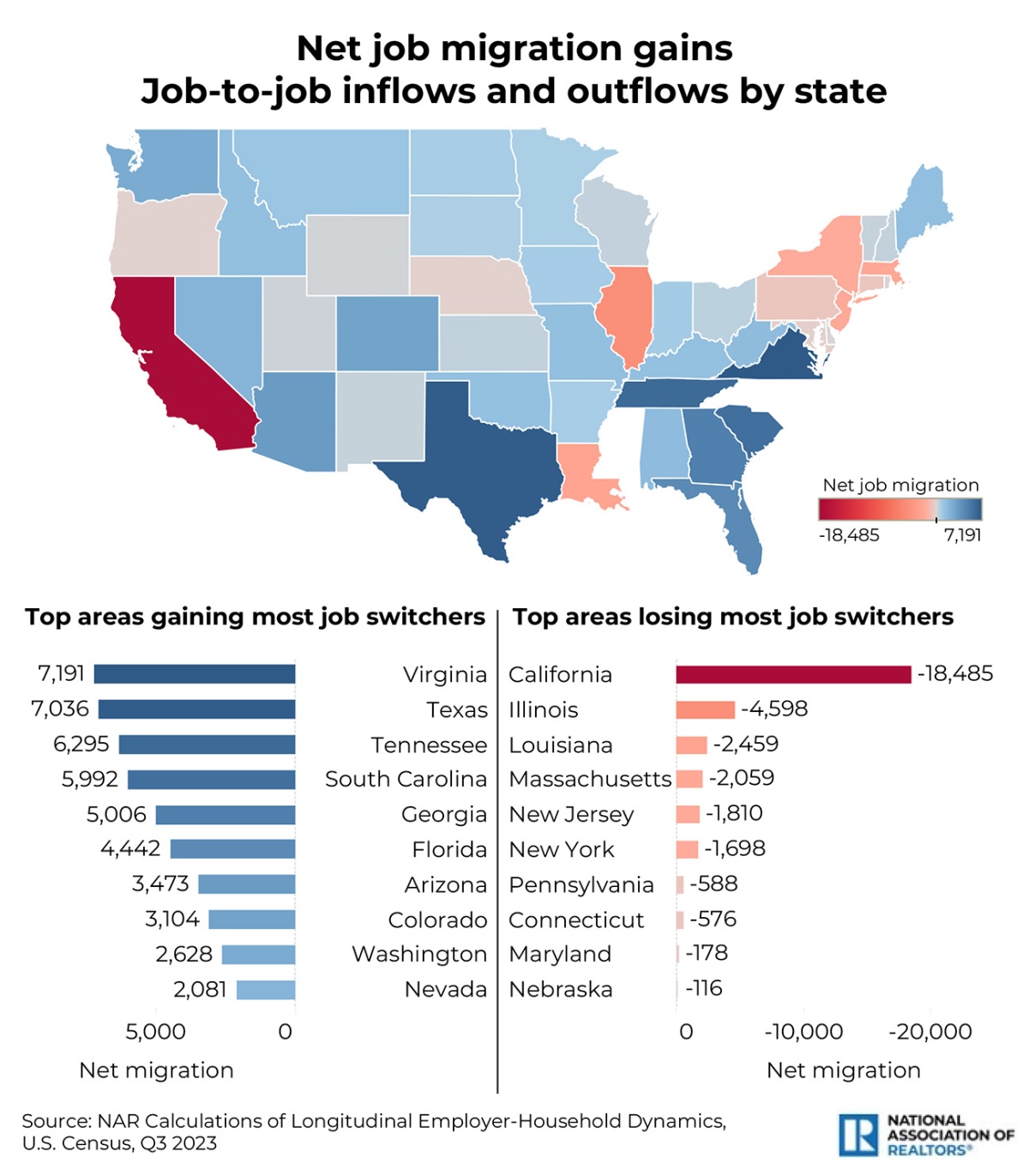

The job-to-job flow data shows clear patterns: Certain states are experiencing higher inflows of workers. States like Virginia, Texas, Georgia, South Carolina, and Tennessee are gaining the most workers thanks to their strong job markets, relatively lower living costs, and attractive business environments. On the other hand, high-cost states like California and New York are seeing net outflows as workers seek more affordable living options without sacrificing career growth.

States With the Largest Net Job Migration Gains: Virginia, Texas, and Tennessee

The states with the largest net job migration, representing the largest gains in workers from other states, are primarily located in the Southeast and Southwest. These regions attract job switchers as they expand their job markets faster than other areas, offer favorable business environments, and are more affordable, contributing to higher job migration.

Virginia leads with a net job migration of 7,191 in Q3 2023, attracting a significant number of workers. Most of those job switchers come from Maryland (18%) and the District of Columbia (12%), which both border Northern Virginia. Florida (8%) and Texas (6%) are a couple of other origin states for those workers starting a job in Virginia. The state’s job market is diverse, supported by sectors such as government contracting, technology, and defense, particularly in Northern Virginia, which benefits from proximity to Washington, D.C.

Texas follows closely with 7,036 net job migrants. Texas remains a major draw for job switchers due to its booming industries and a business-friendly environment with no state income tax. California is the top source of inbound workers, accounting for 12% of the total, as many Californians seek more affordable living options. Major job hubs like Austin, Dallas, and Houston are significantly less expensive than their Californian counterparts while still offering ample career opportunities. Florida (8%), Louisiana (8%), and Oklahoma (5%) are also notable sources of job switchers to Texas.

Tennessee is also among the top states with net job migration gains. This state benefits from growing sectors, such as manufacturing, healthcare, and logistics. Areas like Nashville and Memphis have strong job creation, making Tennessee an attractive destination for job switchers, particularly from neighboring states. Twelve percent of the job inflows come from Georgia, while 10% come from Florida.

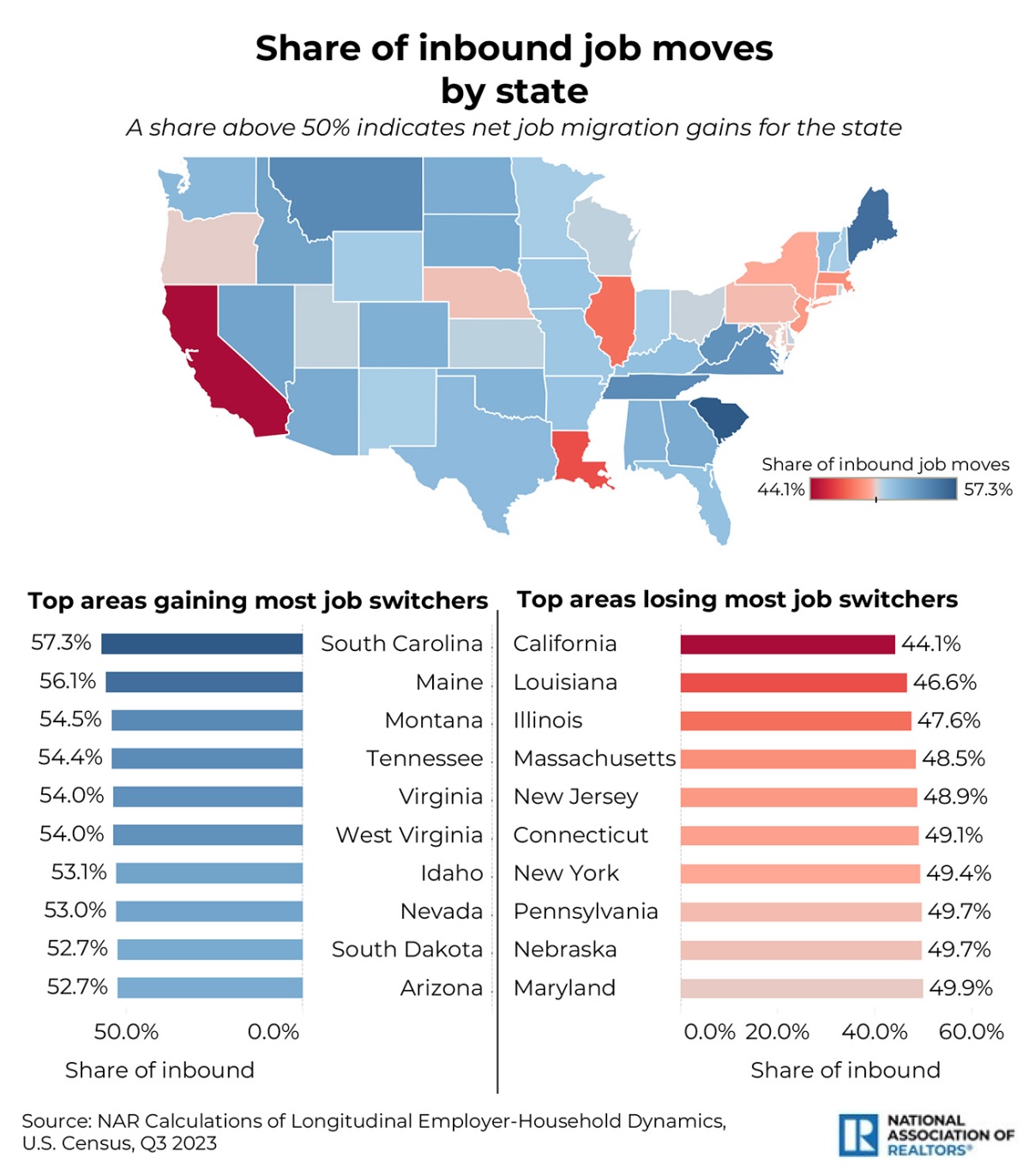

While net migration numbers are useful for gauging overall movement, they don’t fully capture the dynamics between states with very different populations. Larger states naturally have more people moving in and out, so their migration numbers are often much higher simply due to the sheer volume of residents. This makes it difficult to fairly compare them to smaller states, which may have fewer people overall but could be more attractive on a per-capita basis.

To address this, we computed the share of inbound moves for job switchers by state. This metric reflects the proportion of total job moves in a state that come from other states. In other words, it represents the percentage of people moving into a state relative to all job movers in that state, and it helps measure how attractive a state is to job switchers. For instance, Texas recorded 196,240 total job moves (inflows and outflows), with 101,638 job switchers starting a new job and relocating from another state. This results in an inbound job move share of 52% for Texas. However, despite the smaller net migration gains in South Carolina, Montana, and Idaho, their share of inbound job moves exceeded that of Texas, indicating that, relative to all job moves, these smaller states are more attractive to job switchers than Texas.

Top States With the Largest Inbound Job Rates: South Carolina, Maine, and Montana

South Carolina tops the list, with 57% of its job movers coming from out of state. This is mostly attributed to its rapidly growing economy and job market. Areas like Charleston and Greenville are becoming hubs for both established companies and startups, offering job switchers attractive career opportunities coupled with a relatively lower cost of living. More than 30% of those job switchers come from its neighboring states, Georgia (21%) and Florida (11%), while some New Yorkers found a job in South Carolina.

Maine had an impressive share of inbound job moves, with 56% of all job relocations coming from other states. Though it has a smaller population, the state’s strong job creation—especially in health care and emerging industries like renewable energy—make it an attractive destination for companies and professionals who seek both career growth and better affordability. Just a couple of hours away from Boston, many companies and individuals are looking to relocate to a less expensive, less crowded location. Fourteen percent of those job switchers who found a job in Maine come from Massachusetts.

Despite its smaller net migration gain, Montana’s high share of inbound job moves (55%) highlights how attractive this state is to professionals. The state’s economy has created about 11% more jobs than before the pandemic. Montana ranks as the fifth fastest state for job growth post-pandemic. Montana’s relatively lower cost of living attracts professionals from higher-cost states who are willing to trade urban living for a more rural environment. Eleven percent of those job switchers come from Washington, and 9% come from California.

Top States Losing Most Job Switchers

California: The Challenge of Retaining Talent

While California remains a major job market, the state saw nearly 87,000 professionals leave for opportunities elsewhere, surpassing its job inflows of about 69,000. High housing costs—particularly in areas like San Francisco and Los Angeles—coupled with a high cost of living, have driven many workers to relocate to more affordable states like Texas and Arizona. California’s high state income taxes push workers to states with more favorable tax policies, such as Texas. Specifically, 14% of professionals found jobs in Texas, and 9% in Arizona. Washington (8%) and Nevada (7%) are a couple of other popular destinations for Californian professionals.

Louisiana: Ongoing Job Recovery

Louisiana is another state experiencing more outflows than inflows, with about 20,000 professionals leaving for new job opportunities and only 17,000 moving in. Louisiana’s economy has not kept pace with national trends in job creation. The state still struggles to recover the jobs that were lost during the pandemic. In the meantime, Louisiana also faces competition from neighboring states like Texas, Florida, and Georgia, which experience faster job growth. Forty-one percent of those professionals who exited Louisiana for Texas left for better job opportunities.

The Impact on Real Estate Markets

These migration patterns have profound implications for local real estate markets across the states with high job inflows, such as Virginia, Texas, and South Carolina, which are experiencing increased demand for housing as more people move in. As demand for housing increases, home prices tend to rise. For instance, home prices in Richmond, VA, are nearly 13% higher than a year ago.

High demand also spurs residential construction projects. Developers are more likely to build new homes to accommodate the growing population of professionals. For example, both Austin and Houston, Texas, issue 40% more single-family permits than the historical average, while single-family permit issuance is about 70% higher than the historical average in Greenville, SC.

As professionals relocate and more companies demand their employees to return to the office full time, the commercial real estate market is also affected. There may be growing demand for office space in states that are gaining job switchers. Job migration brings more professionals to an area, and businesses may need to expand or relocate their operations to accommodate a growing workforce. This could increase demand for commercial office space, especially in high-growth industries like tech, finance, and healthcare. Indeed, many of these areas, popular destinations to job switchers, such as the Texas Triangle— Austin, Houston, and Dallas—Columbia and Greenville in South Carolina, were among the markets that were able to shift office absorption from negative to positive in 2024. This means that these markets were able to boost office demand this year at a level with more occupied than vacated office spaces. For instance, office absorption in Austin, TX, rose to almost 1 million square feet from -1.3 million square feet a year ago. Respectively, office absorption in Columbia, SC, increased to 1.0 million square feet from -250K a year ago.

Areas experiencing job migration gains may also see increased demand for retail and service-oriented real estate, as new residents boost demand for local amenities like restaurants, shows, and healthcare facilities.

The National Association of REALTORS® views job migration as a key indicator for real estate markets, especially for the office sector, which was heavily impacted by the pandemic. Net job migration data will now be incorporated into the local market reports and updated quarterly. Stay tuned for the latest updates!

The visualization below shows the states of origin and destinations of job switchers for each state.

Methodology

For this analysis, the National Association of REALTORS® used the Longitudinal Employer-Household Dynamics data released quarterly from the U.S. Census Bureau. The latest release included data as of Q3 2023. This data shows the job-to-job transitions by origin and destination state. The U.S. Census doesn’t release any data for Alaska, Michigan, Mississippi, and North Carolina.

The share of inbound job moves refers to the proportion of workers switching to new jobs from other states relative to the total number of job-to-job transitions both into and out of the state. A share above 50% indicates that more job-to-job transitions are entering the state than leaving, resulting in net job migration gains. Conversely, if the share falls below 50%, the state is experiencing a loss of job switchers.