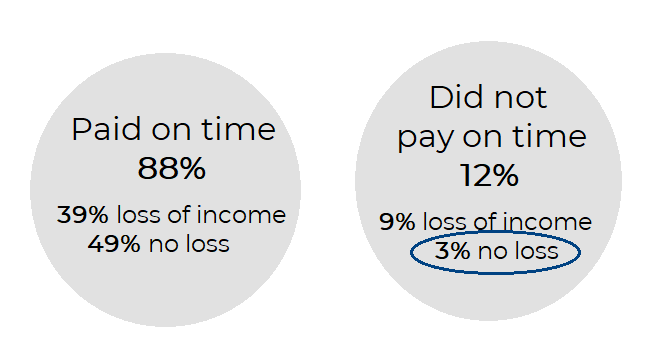

The Coronavirus Crisis has people struggling to pay bills: twelve percent of homeowners did not pay on time their mortgage last month, according to the U.S. Census.

New data from the U.S. Census shows that:

- 12% of mortgage holder households did not make their mortgage payment on time; 41% of them deferred their payment,

- Among the owners who paid on time last month’s payment, 44% of them experienced a loss of employment income,

- 31% of those who did not pay on time used the stimulus package but it was not enough to cover the cost,

- 63% of the owners have high confidence in their ability to make next month’s payment while 21% have moderate confidence. However, the level of confidence is lower for Hispanics and African Americans.

The U.S. Census releases the results of the 2020 Household Pulse Survey every week (starting April 23, 2020). The 2020 Household Pulse Survey (HPS), an experimental data product, is an Interagency Federal Statistical Rapid Response Survey to Measure Household Experiences during the Coronavirus (COVID-19) Pandemic, conducted by the Census Bureau in partnership with five other agencies from the Federal Statistical System:

- Bureau of Labor Statistics (BLS)

- National Center for Health Statistics (NCHS)

- Department of Agriculture Economic Research Service (ERS)

- National Center for Education Statistics (NCES)

- Department of Housing and Urban Development (HUD)

Specifically, the HPS asks individuals about their experiences regarding employment status, spending patterns, food security, housing, physical and mental health, access to health care, and educational disruption. The survey is designed to be longitudinal, which means that this data provides insights with regard to how household experiences changed during the pandemic. Thus, the ultimate goal of this weekly survey is to understand how individuals are experiencing this period and respond to the business curtailment and closures, stay-at-home and safer-at-home orders, school closures, changes in consumer patterns and the availability of consumer goods, and other abrupt and significant changes to American life.

The National Association of REALTORS® closely monitors the results of this survey in order to address the needs and concerns of people in regards to housing during the pandemic. Particularly, the HPS provides estimates about the last month’s payment status for owner- and renter-occupied housing units and confidence in the ability to make next month’s payment.

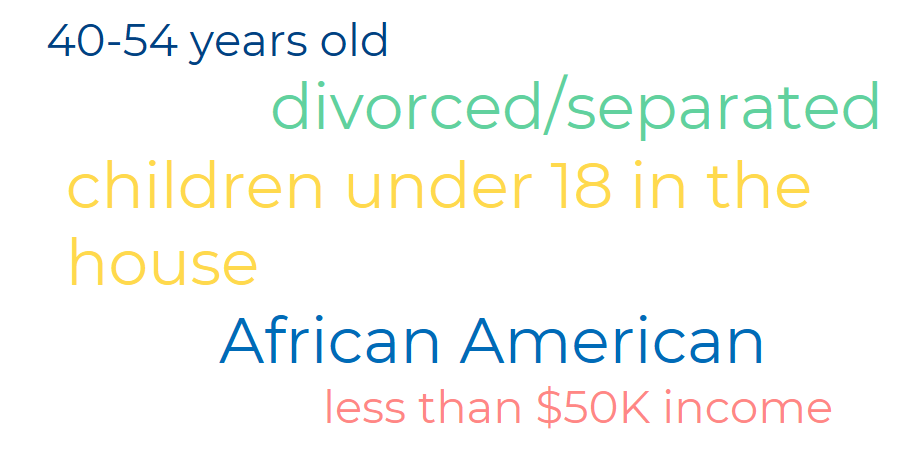

As the data shows, 12 percent of all mortgage holder households did not pay on time last month’s payment.1 This actually translates to 12.3 million people across the country. Particularly, it is estimated that 7.3 million mortgage holders did not pay last month’s payment (partial payment, full payment but late or no payment at all) while 5.0 million deferred their payment. The HPS also provides information about the age, race, income, marital status, and household size of these homes. Taking a closer look at the demographics, most of these owners who were not able to pay last month’s payment on time were: