The age of home buyers is a key demographic variable that provides valuable insights into the local economic health, the housing market dynamics, and cultural trends of an area. Areas with high concentrations of young buyers may suggest a strong job market and vibrant community, attractive to younger professionals. Additionally, many young buyers in an area typically increase the demand for starter homes, which are often more affordable and smaller than the typical size. Younger buyers also strongly prefer smart home technologies, energy efficiency, and flexible spaces, affecting the trends in home design and construction of homes at the local level.

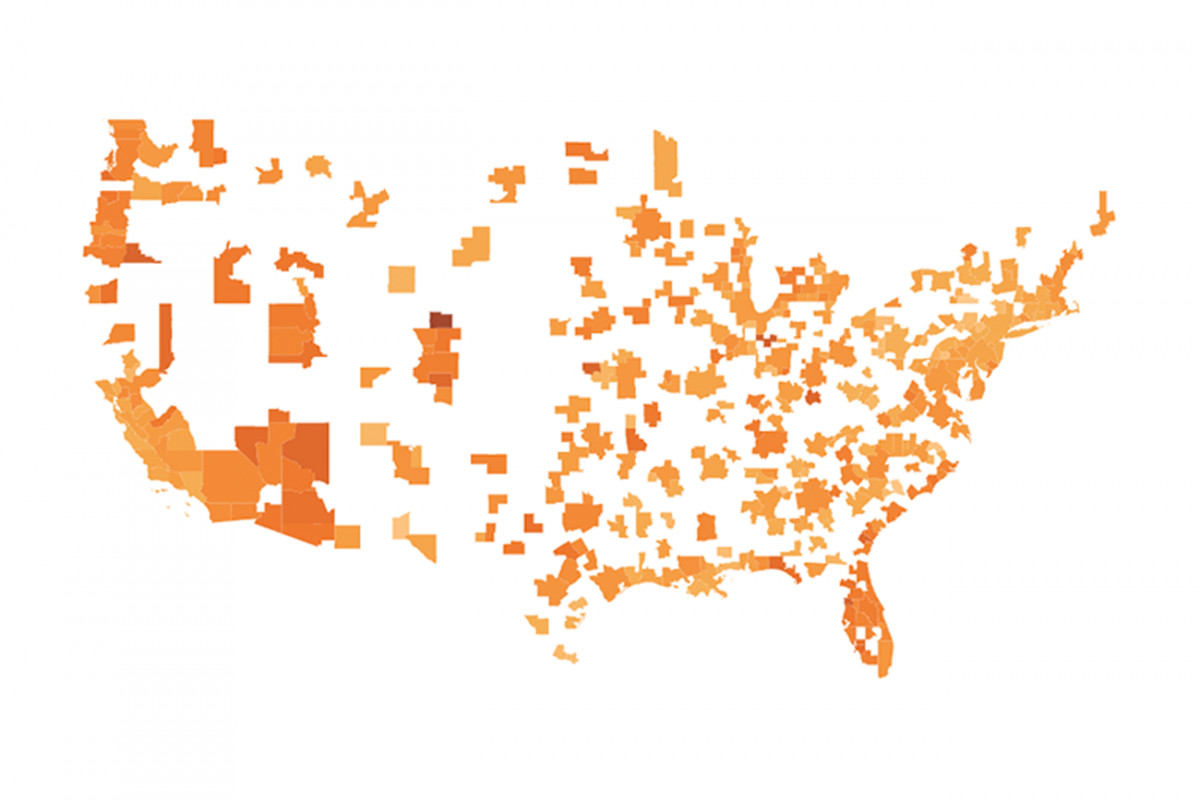

The National Association of REALTORS® computed the median age of home buyers within each region, state, and among the 200 largest metro areas. After estimating the concentration of Gen Z (born between 1999 and 2004) and Millennial (born between 1980 and 1998) buyers, the current analysis identified the areas where young people can still purchase a home.

Data indicates significant variations in the age of home buyers across the country.

By Region

Across the regions, it's unsurprising that the Midwest had the youngest median home buyer age at 39 years on average over the past five years. The Northeast is a close second at the median age of 40, whereas the oldest home buyers are in the West and the South regions. These variations in home buying age are mostly driven by factors such as the cost of living, housing affordability, availability of homes, and demographic trends. For instance, better housing affordability and lower living costs in the Midwest enable younger individuals to enter homeownership earlier than their counterparts who live in more expensive regions. In contrast, the West, with its mix of tech hubs and expensive coastal cities, had a higher median age, reflecting the significant cost barriers for younger home buyers. In addition, the older age of home buyers in the South can be attributable to the demographic trend of that region, which is known to attract older generations. In other words, a greater density of older individuals within the population can skew the median age of buyers upwards in the South.

By State

Consequently, seven of the top 10 states with the youngest home buyers are in the Midwest region. Among them, North Dakota records a median home buying age of 34, Iowa at 36, and South Dakota at 37 years, all registering median ages under 38 on average in the last 5 years. In contrast, Florida had the oldest median at 52 years. Arizona (50 years), Nevada (46 years) and Oregon (46 years) followed with a median home buying age greater than 45 years.

Metro area

At a more granular level, within the 200 largest metro areas, the National Association of REALTORS® computed the number of Gen Z and Millennial home buyers in 2022, along with their income and the price of homes they purchased.

In the following areas, young people can still purchase a home:

Areas With the Most Gen Z Buyers:

Lincoln, NE, has a 27.7% share of Gen Z buyers, with a median household income of $41,930 and a median property value of $199,030.

Tuscaloosa, AL: has a 20.9% share, a median household income of $82,535, and a median property value of $298,960 for Gen Z buyers.

Eugene-Springfield, OR: has a 16.3% share, median household income of $74,170, and a median property value of $382,290 for Gen Z buyers.

Toledo, OH: 14.2% share, median household income of $33,730, and a median property value of $114,950 for Gen Z buyers.

South Bend-Mishawaka, IN-MI: 13.9% share, median household income of $36,705, and a median property value of $212,465 for Gen Z buyers.

Among these areas with the most Gen Z buyers purchasing a home, the variation in median household incomes and property values suggests that these home buyers are active in diverse housing markets, from more affordable areas like Lincoln, NE, and Toledo, OH, to higher-cost markets such as Eugene-Springfield in Oregon. What’s consistent with these buyers is that they spend more than 30% of their income on housing. For example, even though housing is less expensive in Lincoln, NE, these Gen Z buyers must allocate nearly 40% of their income for their mortgage payments.

Compared to the typical homebuyer, data shows that the median household income of Gen Z buyers is typically lower than that of the typical buyer, which aligns with Gen Z's entry-level income status. Another observation is that Gen Z buyers generally have a higher average owner cost as a percentage of income than the typical buyer, highlighting Gen Z's financial challenges in achieving homeownership. Among the 200 largest metro areas, Gen Z buyers spend 37% of their income on their mortgage compared to 26%, which is the average cost-to-income ratio for the typical buyer. Thus, Gen Z buyers must stretch their budgets more to become homeowners.

Areas With the Most Millennial Buyers:

Sioux Falls, SD: has a 68.9% share of Millennial buyers, with a median household income of $93,710 and a median property value of $334,910.

Amarillo, TX: has a 67.7% share, a median household income of $92,270, and a median property value of $247,200 for Millennial buyers.

Denver-Aurora-Lakewood, CO: has a 67.5% share, a median household income of $129,730, and a median property value of $604,150 for Millennial buyers.

Clarksville, TN-KY: has a 67.3% share, a median household income of $45,590, and a median property value of $268,780 for Millennial buyers.

Corpus Christi, TX: has a 66.1% share, a median household income of $76,780, and a median property value of $224,270 for Millennial buyers.

While the economic and market conditions vary across these top areas, they share some key factors that make them attractive to Millennial home buyers. First, Millennial buyers in these areas have a balance between their income and housing costs. Even in areas with higher property values or lower median incomes, the share of income that goes towards homeownership costs remains within a manageable range for Millennials. For example, the share of owner cost-to-income ratio is below 28.0% in the Denver metro area.

Compared to the typical buyer, the median household income for Millennial home buyers is closely aligned with or even exceeds that of the typical home buyer, highlighting the economic strength of Millennials in these areas. These buyers also purchase homes with a value comparable to or slightly above that of the typical home buyer, suggesting that Millennials are competitive in the housing market and are purchasing similarly valued properties. However, data shows that Millennials are more cost-burdened compared to the typical buyer, as the share of owner cost to income is slightly higher in most of the top markets compared to the typical home buyer. The average cost-to-income ratio is 27% for these Millennial buyers compared to 26%, the average ratio for the typical buyer in 2022. This indicates that Millennials must stretch their budgets more than the typical home buyer to purchase properties in these areas.

Overall, whether it’s the better affordability or job opportunities that attract these young professionals to these areas, the significant presence of Gen Z and Millennial home buyers indicates a trend towards early homeownership that will affect the real estate market in the years to come.

NAR has also created a tool that allows you to navigate the demographics of home buyers for each racial/ethnic group by metro area.