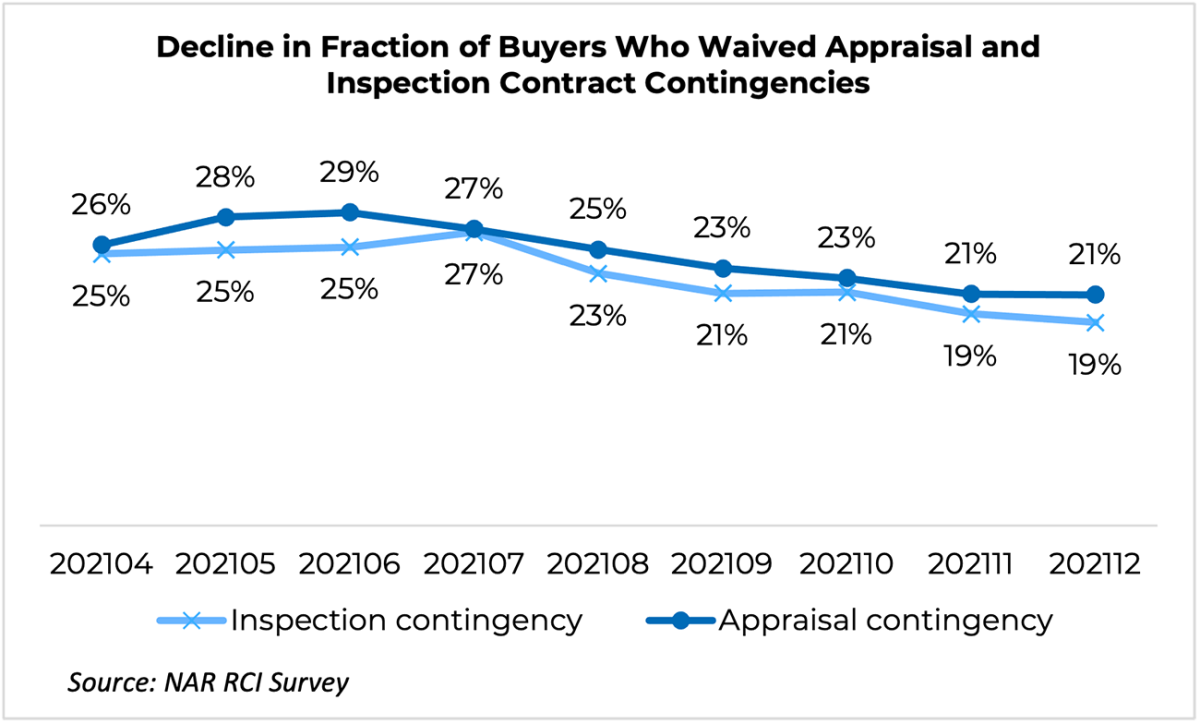

The fraction of buyers who are waiving appraisal and inspection contract contingencies has been trending downwards in recent months, according to NAR’s December 2021 REALTORS® Confidence Index Survey, a survey of REALTOR® transactions. In the December survey, 19% of buyers waived the inspection contract contingency, down from a peak of 27% in July 2021, while 21% of buyers waived the appraisal contract contingency, also down from a peak of 29% in June 2021.

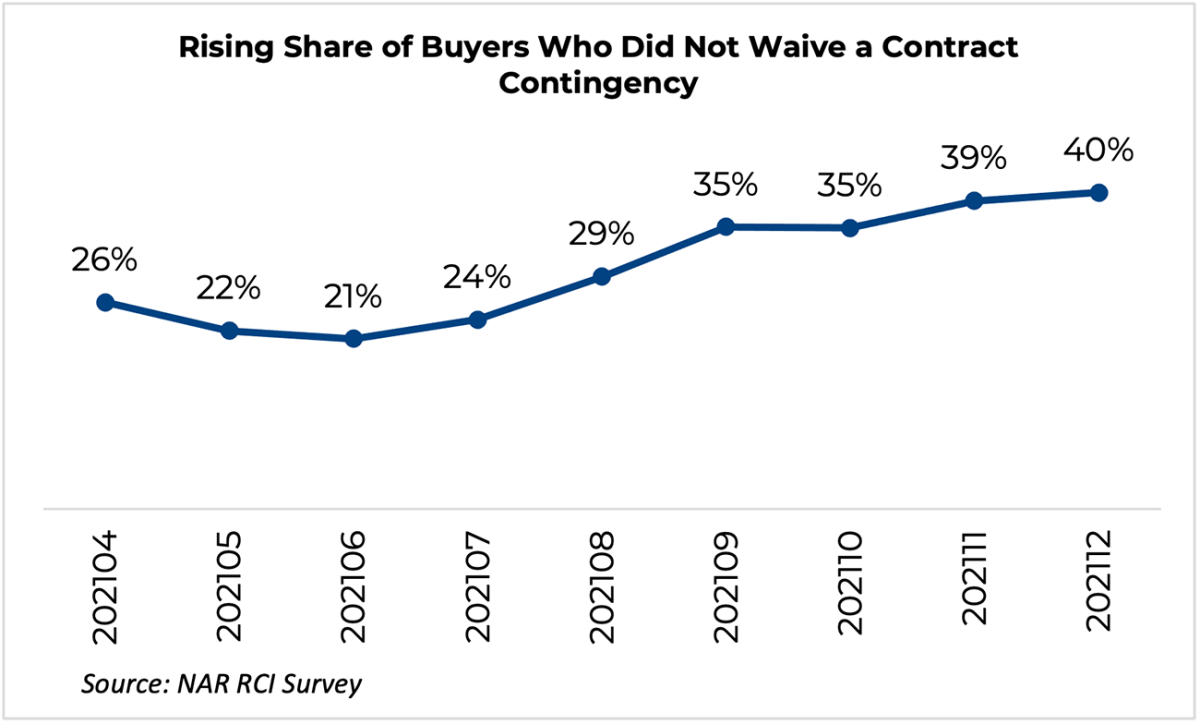

Conversely, a higher fraction of buyers did not waive any contract contingences—40% in December 2021 from just 21% in June 2021. Other contract contingencies that buyers waived were a financial contingency (10%), home sale contingency (8%), title contingency (1%), and other contract contingencies (1%).

Due to tight inventory and with properties selling quickly, the market went into a frenzy as buyers resorted to several measures to outbid other buyers, such as waiving inspection and appraisal contract contingencies, making higher down payments, and offering cash. Appraisal and inspection waivers accelerated during the months of April through June which is a month when sales are seasonally rising.

What might account for the decline in the share of buyers who waive contract appraisal and inspection contingencies?

One reason could be that with home prices continuing to rise, buyers are making sure they are getting their money’s worth. A home purchase is the biggest investment a typical family makes, with the value of a home typically accounting for nearly 80% of total family wealth among homeowners, according to NAR’s analysis of the 2019 Survey of Consumer Finances.1 As of December 2021, the median existing-home sales price rose to $358,000, up 15.8% on a year-over-year basis.

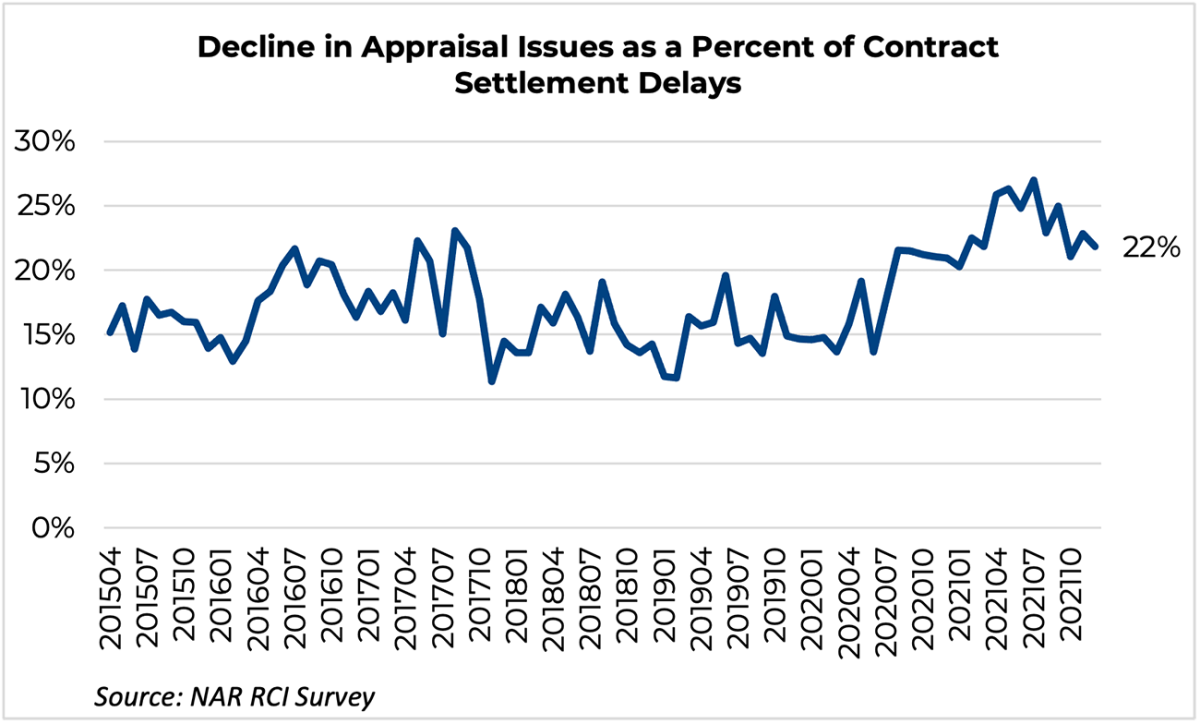

The other reason is that the appraisal process appears to be moving faster. With the onset of the pandemic, appraisal issues accounted for a higher fraction of contract settlement delays, from about 15% prior to the pandemic in January 2020 to a peak of 27% in July 2021.2 Contract appraisals accounted for just 22% of contract settlement delays in the past three months to December 2021. However, with increasing vaccination rates, it is likely that more appraisers are able to conduct an inspection or that an in-person appraisal can be scheduled so appraisal delays have declined compared to January through July.

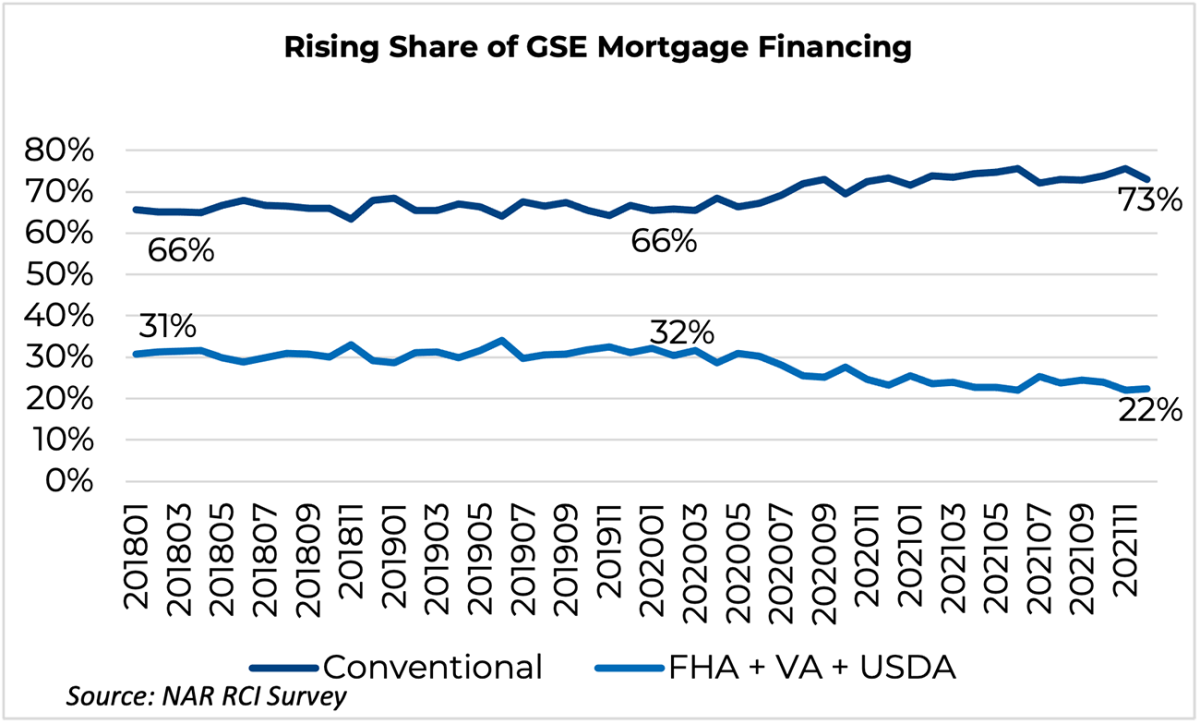

The higher share of GSE financing could also account for the decline in appraisal delays. As of December, GSE financing accounted for 73% of mortgage financing, up from 66% in January 2020, according to NAR’s RCI survey of REALTORS®. On the other hand, the share of mortgage financing from FHA, VA, and USDA loans has declined from 32% pre-pandemic to just 22% as of December 2021. According to NAR’s RCI December 2021 survey, about 5% of appraisals conducted were via a desktop/automated valuation process.3 Fannie Mae and Freddie Mac had used desktop underwriting prior to the pandemic. FHA also recently launched an automated underwriting system in October 2020.

The decline in buyers who are waiving appraisal and inspection contingencies is a healthy trend. Buyers should pay for what a home is worth and be informed of potential issues that need to be addressed by the seller or anticipated by the buyer if the buyer wants to take the responsibility for addressing this issue at their own cost. If so, the buyer can negotiate for a lower price.

Older homes are particularly more likely to have structural issues, which can include the presence of lead paint, ground shifting, water damage, etc. About 53% of owner-occupied homes in the United States were built before 1980. The largest percentages of old homes are in Washington, D.C. (79%), New York (77%), Connecticut (70%), Rhode Island (69%), and Pennsylvania (69%).

1 In 2019, the median non-financial asset held by homeowners was $63,400 while the median value of a primary residence is $225,000.

2 The survey asks about contract settlement delays in the past three months so a survey in say January will cover November, December, and January transactions.

3 This is the first time this question was asked in the RCI survey there is no historical RCI series yet.