The conversion of vacant hotels/motels is one way to help ease the housing shortage, according to NAR's report Case Studies on Repurposing Vacant Hotels/Motels into Multifamily Housing.

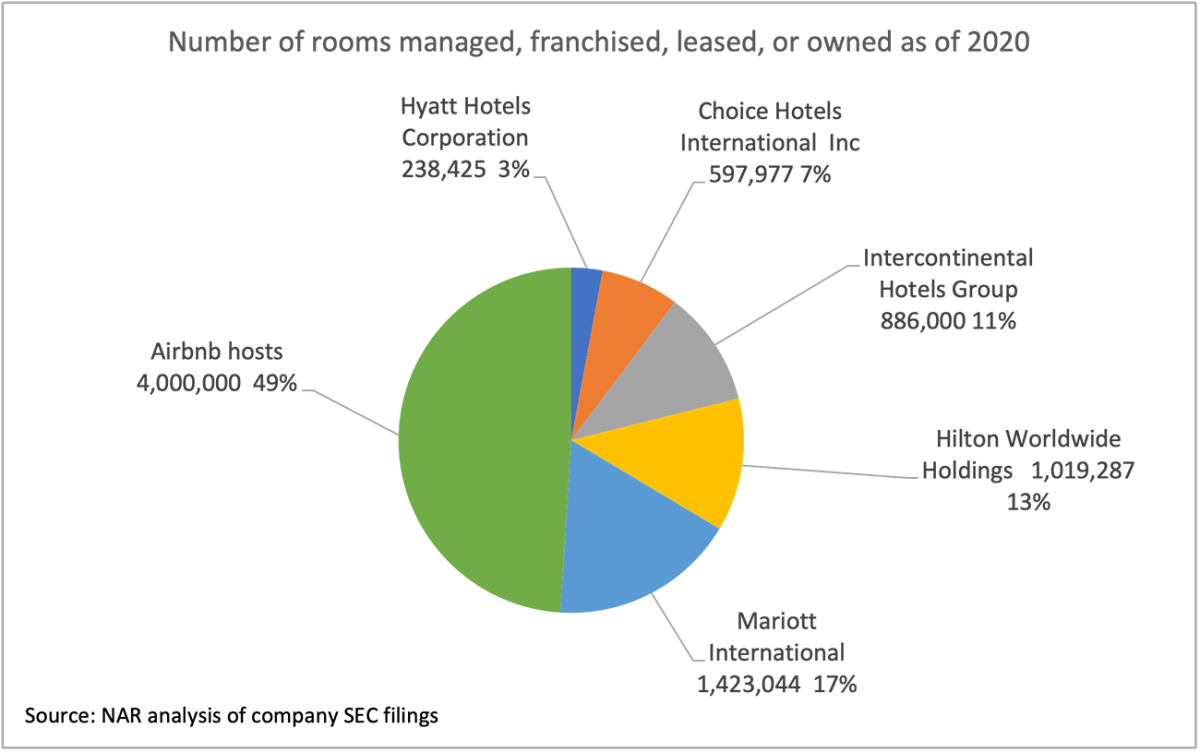

In 2020, the hotel occupancy rate plunged to 37%1 as the COVID-19 pandemic severely cut leisure and business travel and events. Even as the demand for lodging recovers once normalcy returns, stiff competition from short-term rental providers will continue to challenge the viability of the lodging industry. Airbnb has 4 million hosts worldwide, about as much as the combined number of rooms managed, franchised, leased, or owned by the Hyatt Hotels Corporation, Choice Hotels International, Intercontinental Hotels Group, Hilton Worldwide Holdings, and Marriott International.

On the other hand, there is an acute undersupply of housing. During 2010 through 2020, housing completions for single-family and multifamily housing were behind by 6.3 million units compared to the level of housing demand arising from household formation and to replace housing lost to demolition or obsolescence.2 Due to lack of supply, rental housing has become increasingly unaffordable, especially for low-income households. In almost every state, low-income households (earning less than 80% of the median household income) typically spent more than 30% of their income on rent in 2019. Rental housing has become more expensive. In 2020, 22.7% of multifamily rental units rented for over $2,000 compared to just 12.3% in 2017.3

Research Objective, Methodology, and Key Findings

Recognizing that the conversion of vacant hotels/motels is a win-win solution to address the underutilization of hotels/motels and help alleviate the housing shortage, the Commercial Real Estate Research Advisory Board, under 2021 Chair Dawn Aspaas and Vice-Chair Beth Cristina, recommended that a research study be undertaken on the conversion of vacant hotels/motels into multifamily housing to draw some insights and best practices.

NAR Research undertook the research using a two-pronged methodology. NAR conducted 1) a survey of NAR commercial members about their transactions that involved hotels/motels that were planned to be converted into multifamily housing; and 2) secondary research of hotel/motel conversions from company websites, SEC filings, and county records.

NAR commercial members who were engaged in such conversions provided information on 29 conversions. Key findings of the survey:

- 82% of the hotels/motels converted into multifamily housing were located in the suburbs, small town, resort, or rural areas. This accords with the finding that most conversions were of limited-service hotels/motels, which tend to be located outside city centers.

- 54% of the hotels/motels were acquired at a cost of $50,000/room.

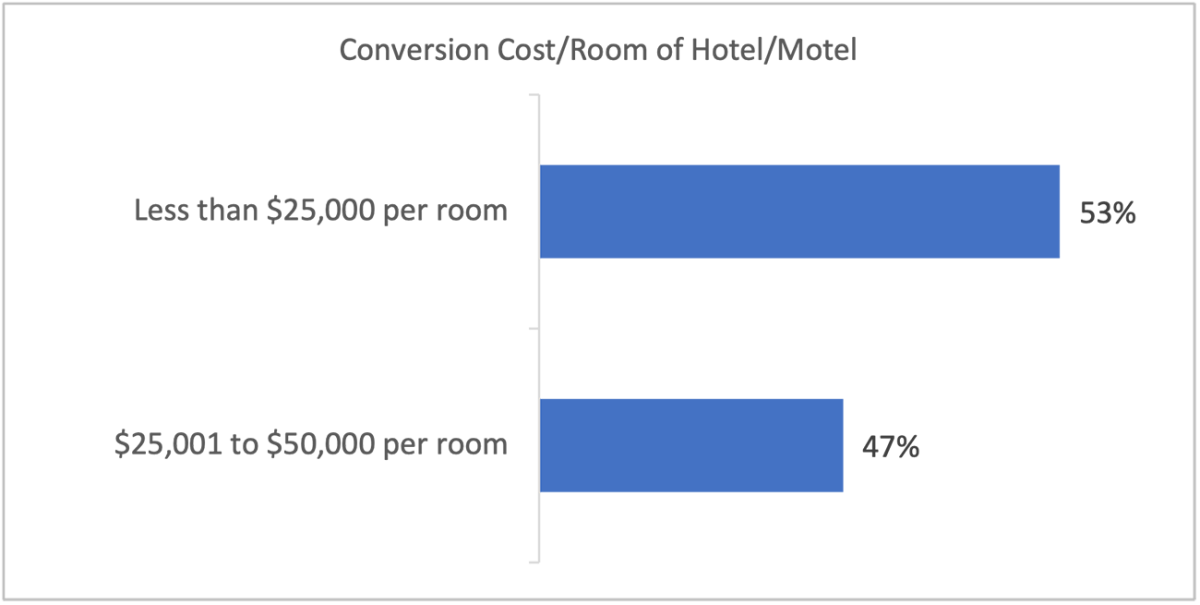

- 53% of the hotels/motels were converted at a cost of $25,000 /room.

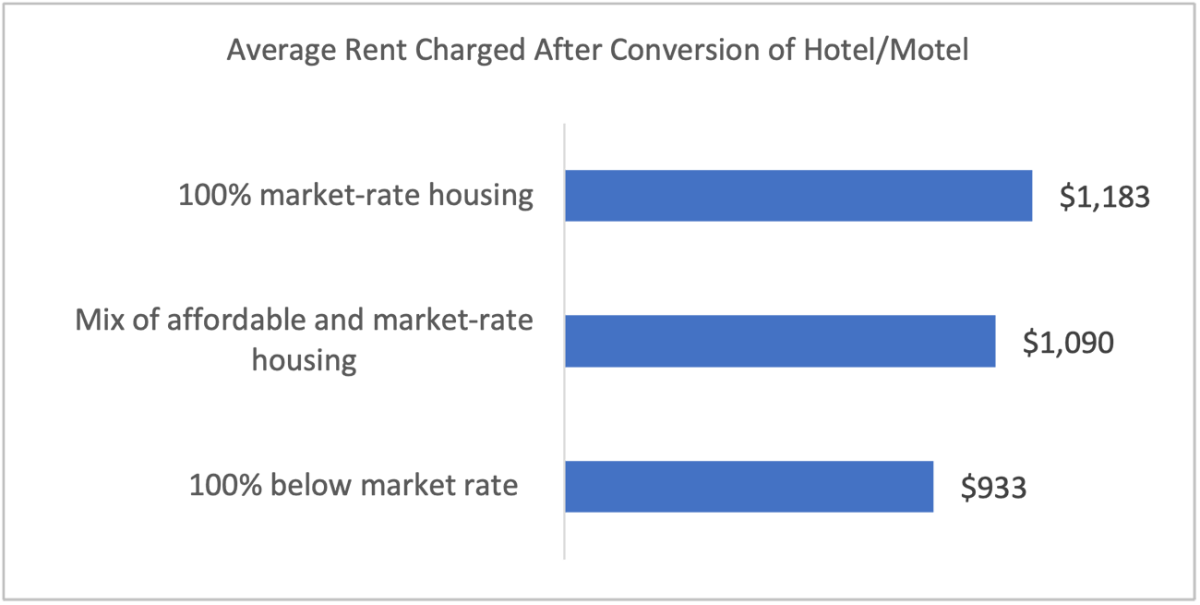

- The average rent after conversion was $1,090.

- 55% of the hotel/motel conversions required rezoning.

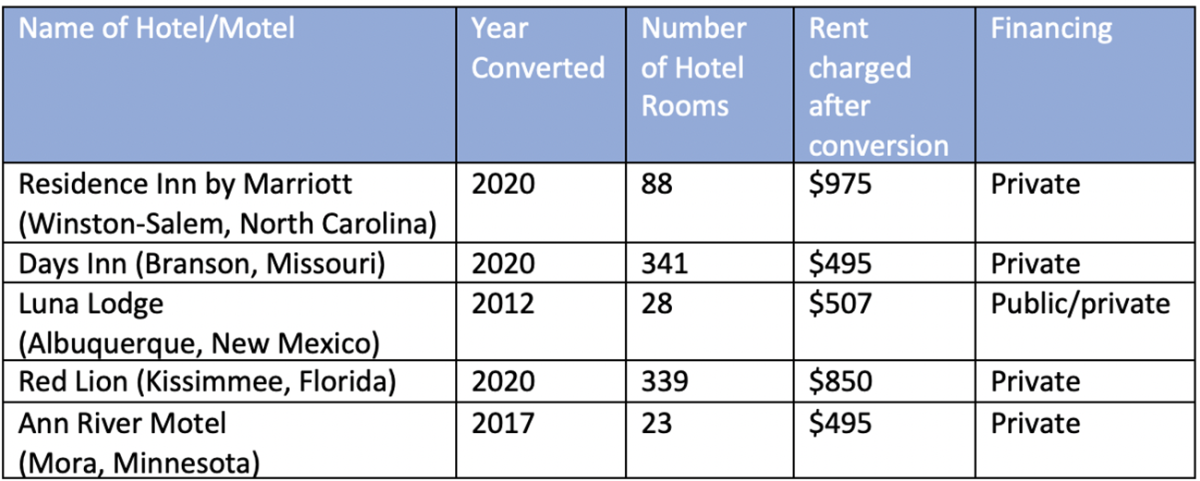

NAR Research Economist Brandon Hardin conducted secondary research on five hotels/motels that were converted into multifamily housing. The case studies show conversions can be purely done by private financing. Where public funding was required, the Low- Income Housing Tax Credit (LIHTC), Historic Tax Credit (HTC), and tax abatement were the common sources of federal/local funding. The case studies underscore how developers need to address the zoning requirements to avoid project delays and get community buy-in early on.

1 Smith Travel Research reported by Choice Hotels in 10-K filing

2 NAR estimate based on US Census Bureau net household formation (March supplement), housing completions, and 0.4% of housing lost to demolition or obsolescence.

3 US Census Bureau, HVS Survey