It's been three years since the United States began facing its highest inflation surge since 1981, which peaked at 9.1% in mid-2022. Although progress has been made in reducing the inflation rate through increased interest rates, the latest Consumer Price Index (CPI) report, which tracks the annual price changes of various goods and services, indicates that the inflation rate remains at 3.4%. This is relatively unchanged from the rate a year ago. Since May 2023, the inflation rate has fluctuated between 3.0% and 3.7%.

One of the categories measured by the CPI is the change in shelter prices. The CPI for shelter includes owners' equivalent rent (how much a property owner would have to pay in rent to be comparable to their cost of ownership), rent, lodging away from home, and tenants' and household insurance. Since April 2023, shelter costs have increased by 5.4%, right behind the 11.2% rise in transportation services. While the 5.4% increase in shelter costs is concerning and adds to inflation, it may not fully represent the overall situation. As a result, the actual inflation rate could be lower than the reported 3.4%.

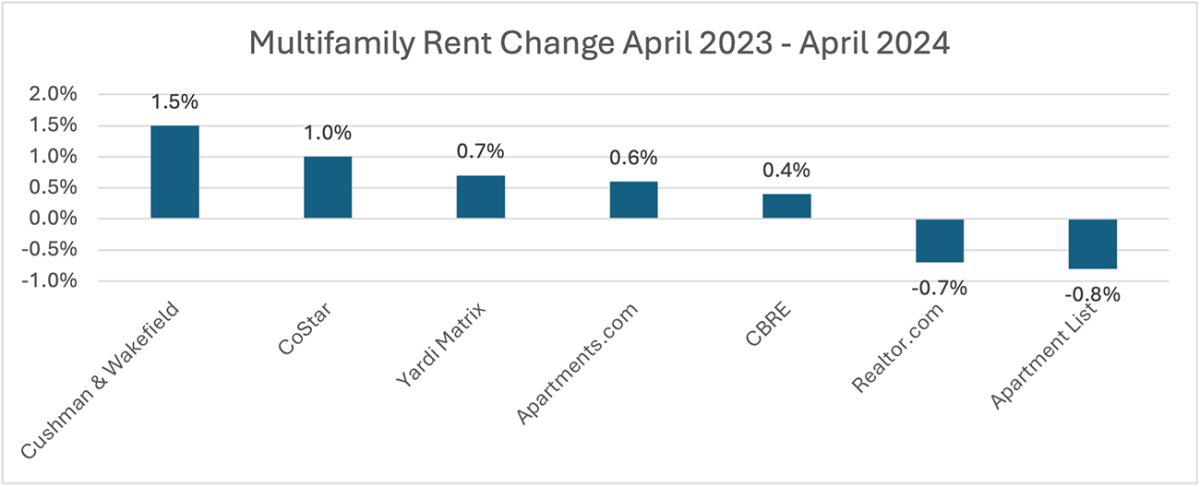

Many real estate firms publish their own data on rent changes, resulting in a range of figures. For multifamily rents, changes ranged from -0.8% to 2.8% between April 2023 and April 2024. These figures align relatively well with the Federal Reserve's target inflation rate of around 2%.

These differences can be attributed to the varying methodologies used by each source. Realtor.com, Apartment List, and Apartments.com track rent changes based on the properties they manage, list, or are otherwise involved with. In contrast, CBRE and Yardi Matrix gather rental data from a variety of markets, while Cushman & Wakefield combine data from the properties they manage with rental data from external sources.

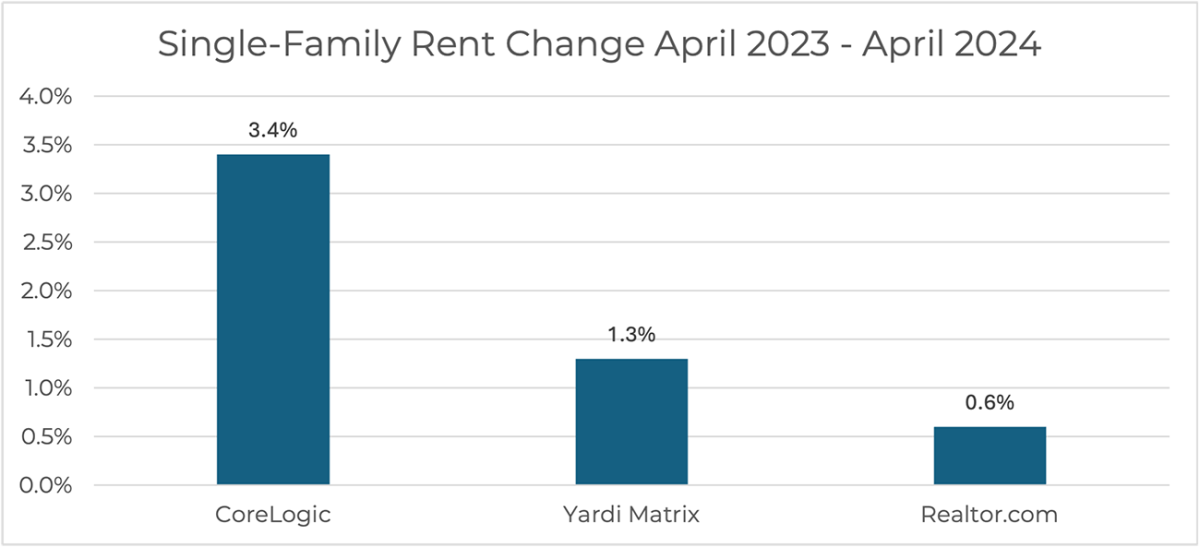

These varying figures can also be seen when looking at single-family rent changes during this same period, albeit with less variation.

Unlike multifamily rents, single-family rents increased for each of the sources.

Both multifamily and single-family rents have increased less than the 5.4% reported in the CPI, with multifamily rents averaging a 0.7% increase and single-family rents averaging a 3.2% increase across various sources. While these sources do not represent all firms that publish rental data, it is reasonable to infer that the actual increase in shelter costs may be lower than the reported 5.4%. Therefore, the true inflation rate could be lower than the 3.4% indicated by the CPI.