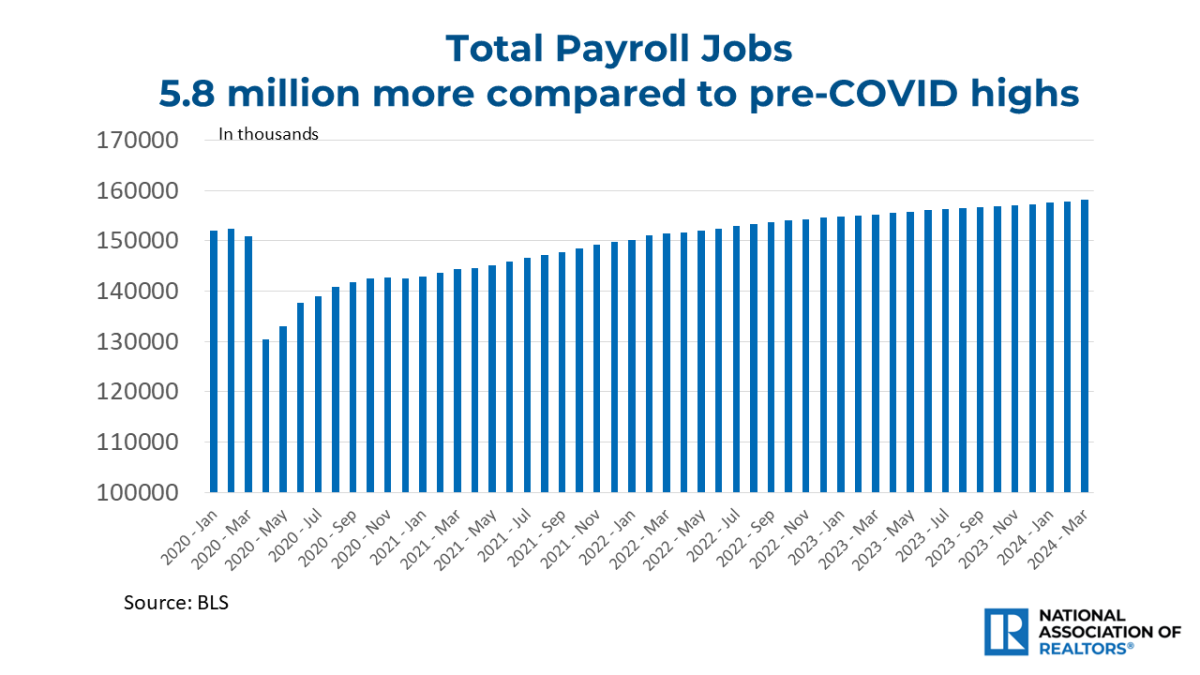

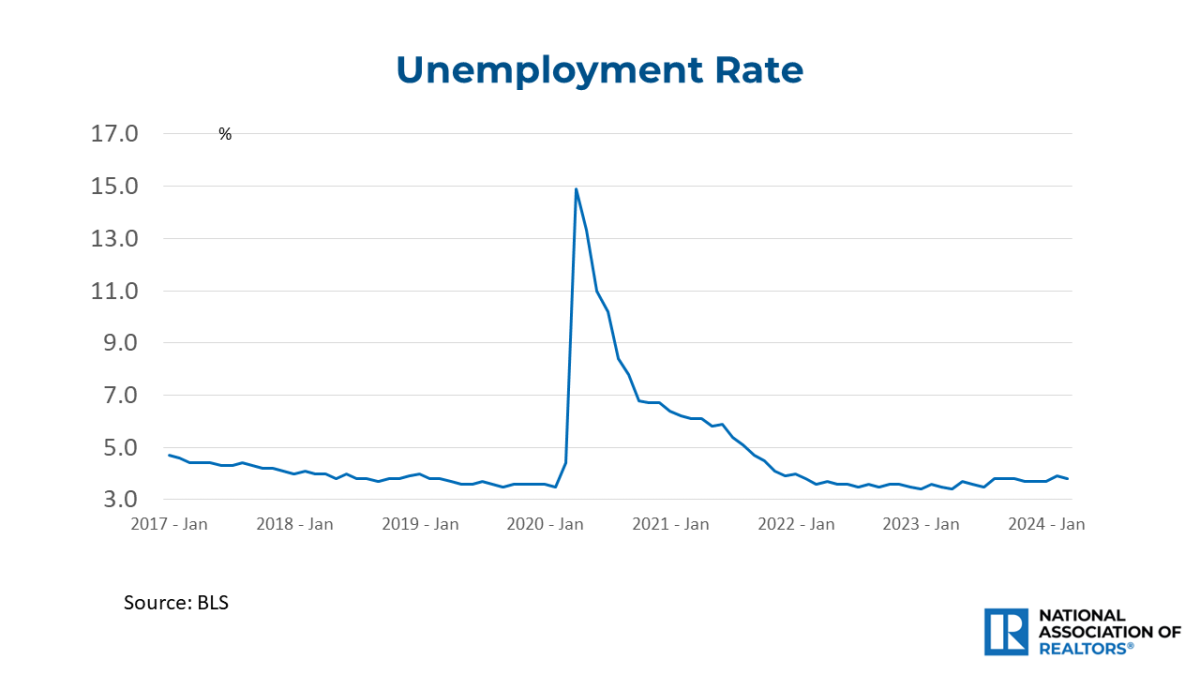

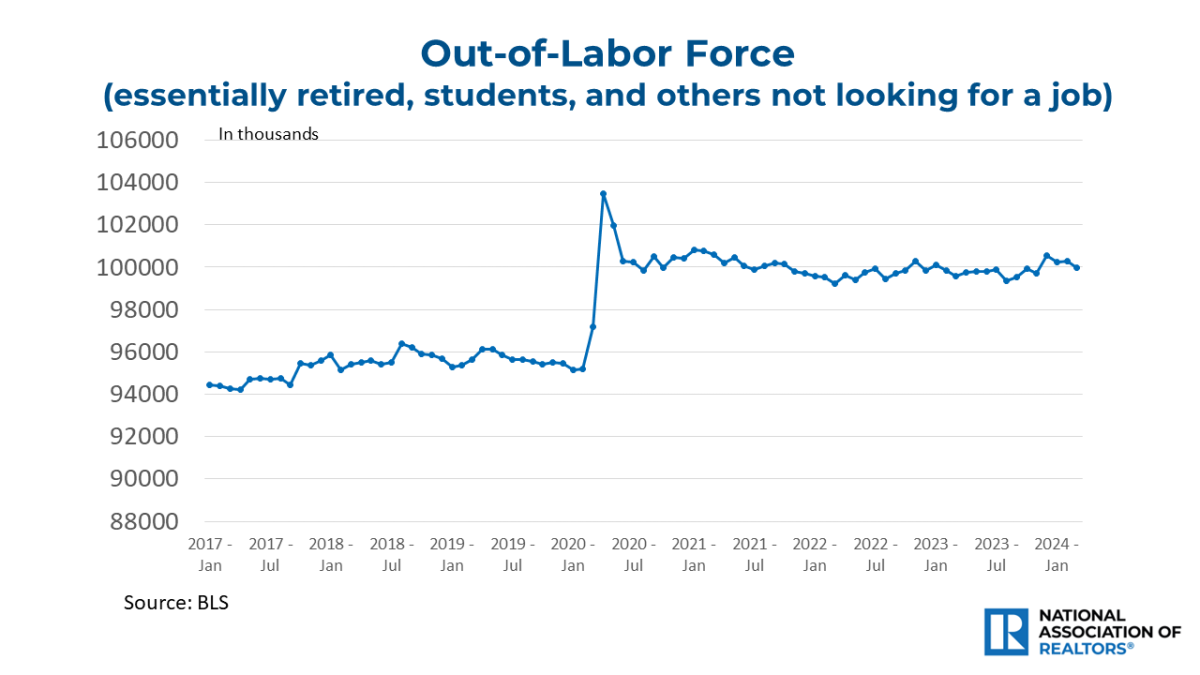

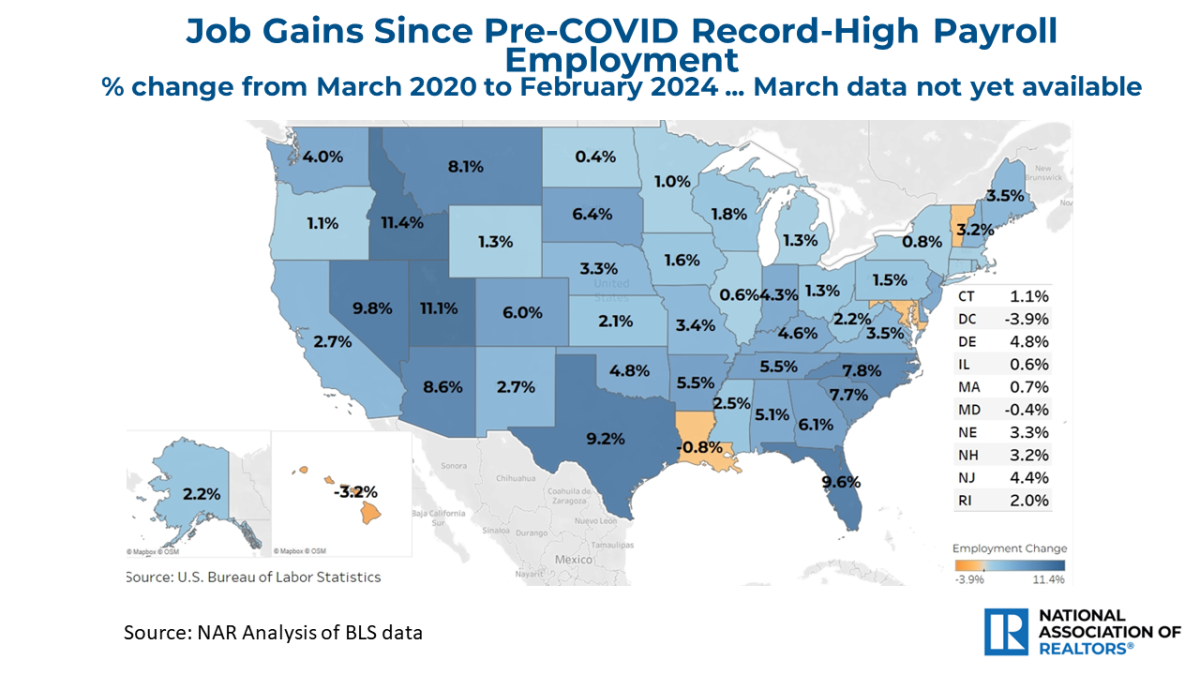

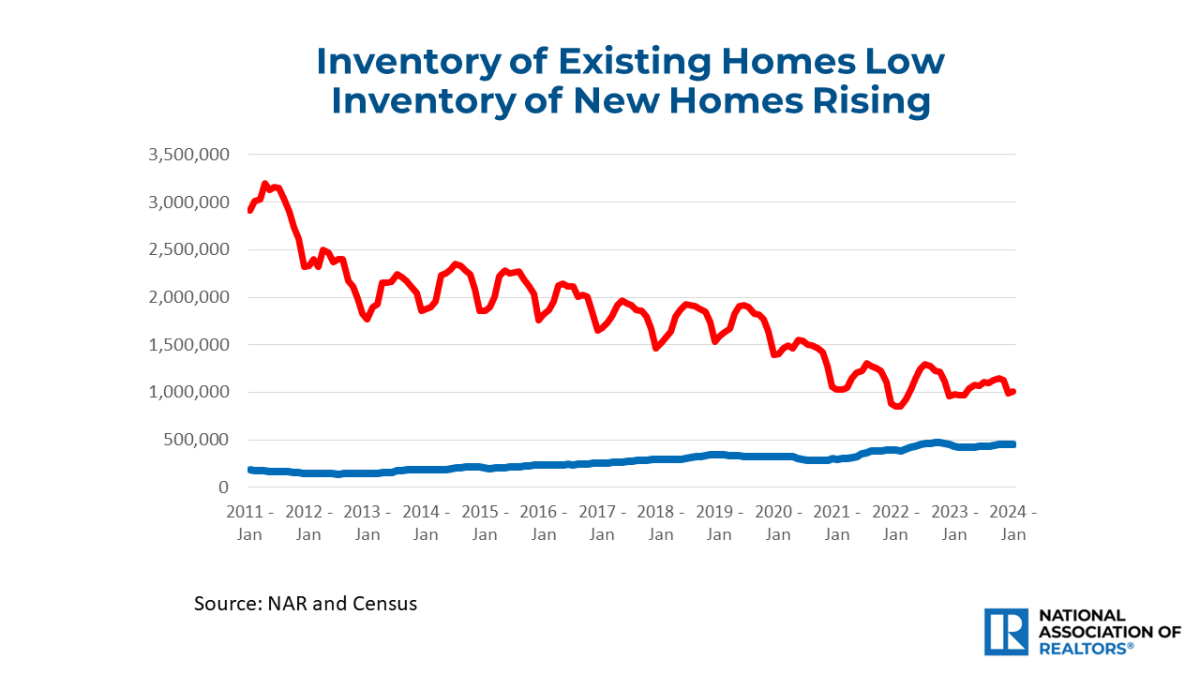

The job market continues to exhibit solid strength, with 303,000 net payroll job additions in March. That brings total job creation to 5.8 million from the pre-COVID peak four years ago. The construction industry added 39,000 net new jobs, up by 600,000 from four years ago. Therefore, more housing supply is on the way in future months.

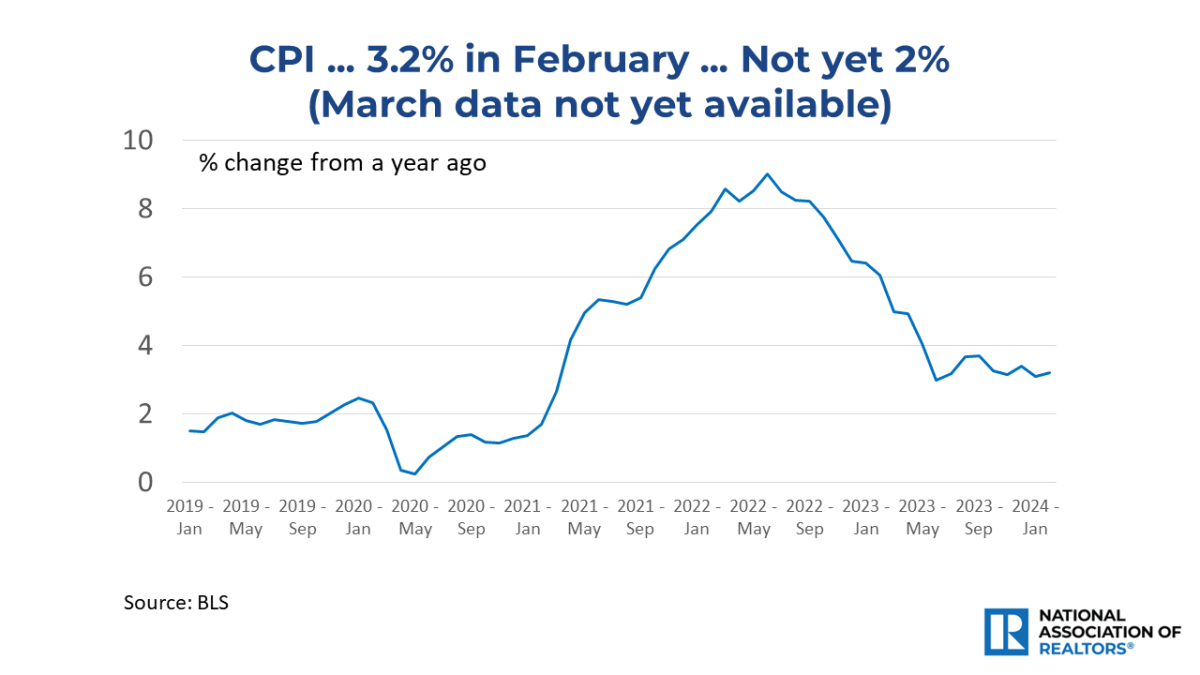

More jobs mean more potential housing demand in the future. But more jobs also mean the interest rate decline could stall as the Federal Reserve re-evaluates inflation risk. Wage growth was 4.1% in March after two straight years of above 5% gains. This decelerating wage growth can lessen consumer price inflation.

Overall, mortgage rates are likely to remain unchanged, with no further measurable declines in upcoming months. High budget deficits will also hinder interest rates from falling as government borrowing crowds out mortgage funding availability. Even so, multiple offers on properties are still happening. Homeowners with record-high housing wealth should understand the current favorable environment for putting homes on the market.